December Markets: Bitcoin continues to power to new all time highs while the US dollar continues…

December Markets: Bitcoin continues to power to new all time highs while the US dollar continues its downward slide

This is an excerpt from our January Market Update

In December crypto continued its strong Q4 with bitcoin setting a new all-time high and finishing 2020 at just under $29k, up 47% for December and 301% for all of 2020. Ethereum (ETH) lagged bitcoin in December at +22% for the month, but ETH was up more for 2020 with almost a 500% gain on the year.

Reporting on December and 2020 figures already feels outdated, as both BTC and ETH have continued rocketing upwards to start 2021: as we go to press bitcoin has crossed above the $40k level and ETH is closing in on its all-time high of ~$1,400, having just crossed back above $1,300 for the first time since January 2018.

Table 1: Price Comparison: Bitcoin, Ethereum, Gold, US Equities, Long-dated US Treasuries, US Dollar (% Change)

December put a strong finish on what was a watershed quarter and year for crypto-Wall Street convergence. While there were numerous positive developments for crypto in 2020, the single most important one in our view was that the bitcoin as “digital gold” thesis came through big time on Wall Street and for other institutional investors.

Investment banks such as JP Morgan and others commented on the apparent rotation some gold investors are making, noting Q4 outflows observed from gold ETFs alongside major increases in crypto funds such as the Grayscale Bitcoin Investment Trust (GBTC) and the Bitwise 10 Crypto Index Fund (BITW).

As we look ahead to crypto markets in 2021, Blockchain.com head of research Garrick Hileman authored a guest article for CoinDesk outlining two major macro forces that should help fuel crypto’s current momentum:

- Outsized government spending and money printing

- U.S.-China economic and geopolitical tension

One possibility Garrick discusses for 2021 is governments for the first time openly acquiring bitcoin (BTC) as a reserve asset. With retail investors, corporates, and Wall Street investors all now embracing bitcoin to various degrees, governments can be viewed as the final frontier of crypto adoption.

But investors should also continue to expect outsized volatility in cryptoasset markets. Some of the traditional warning sign metrics that have signaled the potential for an overheated crypto market are starting to return, including:

- A spike in USD dollar and stablecoin borrowing rates

- Return of the “kimchi premium”

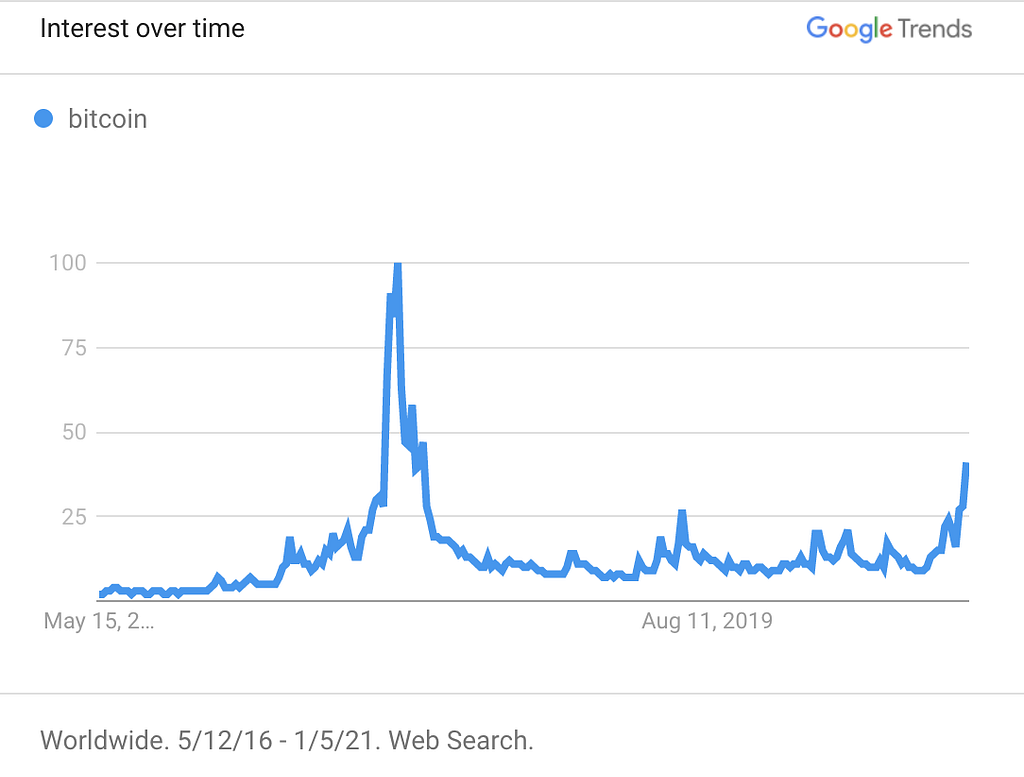

- Rising Google search interest (see below)

December Markets: Bitcoin continues to power to new all time highs while the US dollar continues… was originally published in @blockchain on Medium, where people are continuing the conversation by highlighting and responding to this story.