Bullish on Stablecoins?

Here’s how to invest and profit on their growth via Blockchain.com

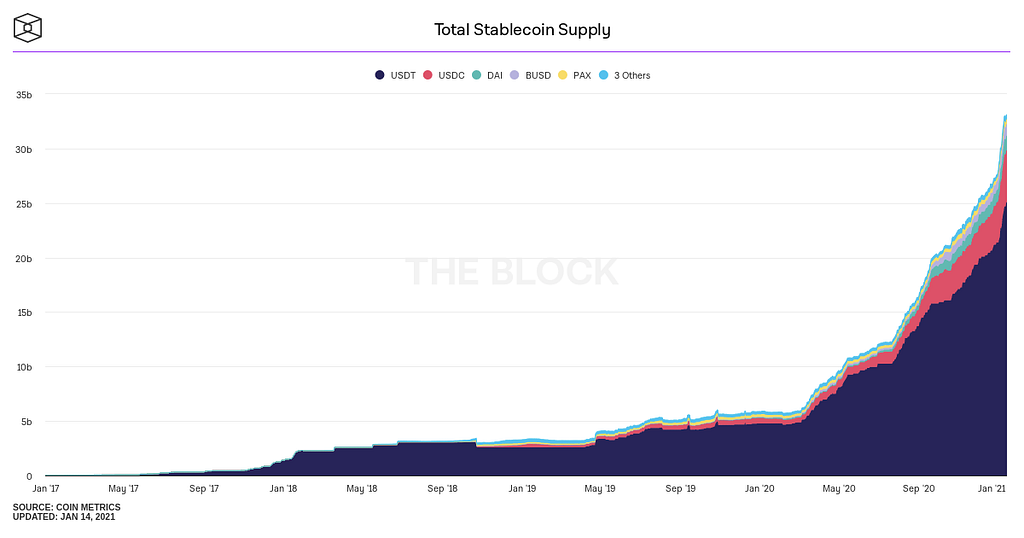

Stablecoins, cryptocurrency tokens that use various mechanisms to keep their price “stably” pegged to a national currency like the US dollar, have been exploding in use lately. It’s a tool to give the user access to many of the benefits of cryptocurrency without the volatility.

They are an obvious choice for active traders who want to flow money between exchanges frictionlessly, and are similarly proving extremely useful for cross border payments in business transactions.

Of late, stablecoins have enjoyed even more growth as they are a preferred way to send money in and out of Decentralized Finance (DeFi) smart contracts. Making fiat money native to platforms like Ethereum will only make it that much easier to use applications on the platform.

There have even been promising regulatory developments around stablecoins. In the U.S., the Office of the Comptroller of the Currency officially clarified that banks can choose to use stablecoins for settlement, further reinforcing that idea that this new piece of financial infrastructure is here to stay.

While it’s not feasible to invest in stablecoins themselves, as their value is fixed, there is still a way to get exposure to this new asset class. A typical stablecoin is built on top of a smart contract enabling blockchain, like Ethereum.

These platforms use native cryptocurrencies (such as ETH in the case of Ethereum) to allocate computing power and manage spam on the network. If demand for stablecoins on a particular network grows, it’s possible that it’s native cryptocurrency (ie ETH) will also see more demand and price appreciation as well.

Four of the most popular platform choices for stablecoins are available for investment via the Blockchain.com exchange and wallet.

- Algorand (ALGO) has gained traction of late via various stablecoins operating atop Algorand network, including:

- USDC

- USDT

- QCAD

2. Ethereum (ETH) is currently the leading stablecoin platform, with some of the more popular stablecoins including:

- USDC

- USDT (supported in the Blockchain.com wallet and exchange)

- DAI

- PAX (supported in the Blockchain.com wallet and exchange)

- (Really it’s almost too many to list)

3. Bitcoin (BTC)

- USDT is the principle stablecoin operating on the Bitcoin via the Omni overlay network

4. Stellar (XLM) has long served as a platform for various stablecoins, which are attracted to its fast settlement times and relatively inexpensive transaction fees

- Stellar recently made waves with the announcement that the Ukrainian government would be testing its central bank digital currency on the Stellar network.

Looking for a non-US dollar linked stablecoin?

Amid growing concerns about the future of the US dollar (which dropped 7% in value in 2020), not everyone is keen on holding a US dollar backed stablecoin.

What alternative “price stabilized” currencies exist?

One asset-backed digital currency alternative to USD stablecoins you may want to consider is a gold-backed token such as DGLD.

Launched jointly by Blockchain.com and CoinShares in 2019, DGLD offers all the storage and transacting convenience of other natively digital currencies like bitcoin (BTC) and ethereum (ETH) but with the added feature of being backed by actual physical gold held in a Swiss vault.

In 2020 gold didn’t perform nearly as well as bitcoin (+301%) and ethereum (+477%), but it was up a respectable +24% for the year.

Crucially for many, it also has a track record of being significantly less volatile than cryptoassets like bitcoin.

If you’re interested in learning more about DGLD and other gold-backed tokens, and how they differ from and compliment ownership of cryptoassets like bitcoin, please check out our research primer on gold-backed tokens.

Dr Garrick Hileman is a visiting fellow at the London School of Economics and the head of research at Blockchain.com, the leading provider of cryptocurrency solutions and creator of the world’s most popular crypto Wallet and the Blockchain.com Exchange. You can read more of his analysis and research on Twitter @GarrickHileman and @Blockchain.

Important note

The research provided herein is for your general information and use and is not intended to address your particular requirements.

In particular, the information does not constitute any form of advice or recommendation by the author or Blockchain.com and is not intended to be relied upon by users in making (or refraining from making) any investment decisions.

Appropriate independent advice should be obtained before making any such decision.

Bullish on Stablecoins? was originally published in @blockchain on Medium, where people are continuing the conversation by highlighting and responding to this story.