When the Game Stops

February Market Outlook

“There are decades where nothing happens; and there are weeks where decades happen.” -Vladimir Ilyich Lenin

We believe future historians will look back on the eye-opening events surrounding the trading of GameStop (GME) stock as extremely significant to the future evolution of financial market infrastructure.

We titled this month’s market outlook “When the Game Stops” because of our heightened conviction that more people are waking up to the massive problems with our existing financial system and are demanding change.

The problems exposed in our opaque and inefficient market infrastructure are not new. What just changed was the broadening visibility of these problems. GameStop helped more people see behind the curtain of how the financial system game is played. And the bipartisan outrage, which is winding its way to Congressional hearings, is justified.

As we discussed a few days ago on our blog, it is hard to imagine a more perfect advertisement for why blockchain technology and DeFi should underpin our future financial system.

One of the most exciting aspects of a more decentralized financial system is that DeFi offers a rare and open opportunity to everyone to invest directly in the next generation of financial infrastructure as it is being built.

At Blockchain.com we are working hard to make sure everyone with an internet connection and computing device, including those without much or any available investable capital, can participate in this new decentralized financial system.

If you are reading this you do not have to sit back and hope or wait for our future financial system to happen. You can not only help make it happen, but you can profit from making it happen.

Crypto has always been a call to arms. If you have not already done so then take a few moments and create a Blockchain.com wallet today. This is the first step in joining us and others as we build a more transparent, efficient, and equitable financial system.

February outlook

We’re now pleased to offer you our latest thoughts on what’s driving crypto markets and analysis of bitcoin on-chain activity this month.

Be sure to also watch and listen to this month’s webinar which features our own Lewis Tuff, VP of Engineering at Blockchain.com, and our discussion of topics like what it’s like to work on the front lines of building crypto infrastructure and why some exchanges suffer downtime.

Summary

- Market movements

- Bitcoin set another all time high in early January at just under the $42,000 before selling off as our head of markets, Charlie McGarraugh, correctly predicted during last month’s webinar; it finished the month +14%

- Ethereum significantly outperformed bitcoin for January (+77%) on anticipation of an upcoming listing on the US Chicago futures market and DeFi growth

- Asset markets in general dropped in January, with stocks (S&P500 -1.1%), gold (-2%) and especially long-dated US treasuries (-3.6%) all registering losses; the US dollar rebounded on the risk-off move and was up 0.7% for the month

- Rising DeFi token values are subsidizing what otherwise might be unsustainably high stablecoin borrowing costs, raising concerns about another near-term correction

2. On-chain insights: Highlights from the Blockchain.com data science team

- The bitcoin network has become more efficient in processing “payments”, which better reflect fundamental on-chain economic activity than “transaction” metrics

- Rising average transaction fees for Ethereum potentially open the door to competitors that might be able to better support any dramatic increase in stablecoin flows

- While the Binance Mining Pool has further diversified the number of top pools, its rising hash rate has coincided with a decline in hash rate share amongst smaller miners

3. Spotlight on Polkadot (DOT)

- Polkadot has been one of the best performing cryptoassets of late and recently moved into the top-5 cryptoassets in total market value at ~$20b at present

- The Polkadot Network positions itself as a Layer-0 Metaprotocol, not an “Ethereum Killer”

- Polkadot is aiming to enable both open and permissioned blockchains to benefit from the same network effects

4. What we’re reading and hearing

1. Market movements: Bitcoin and Ethereum make new all time highs while traditional markets wobble

In January crypto continued its strong Q4 2020 momentum with bitcoin setting a new all-time high at just under $42k in early January, and finishing the month up 14%. Ethereum (ETH) had an even more impressive month at +77%. Both are up around 1,000% over the last two years with Ethereum now outperforming Bitcoin over that time period.

Asset markets in general dropped in January, with stocks (S&P500 -1.1%), gold (-2%) and especially long-dated US treasuries (-3.6%) all registering losses. The US dollar rebounded on the risk-off move in traditional markets and was up 0.7% for the month.

Table 1: Price Comparison: Bitcoin, Ethereum, Gold, US Equities, Long-dated US Treasuries, US Dollar (% Change)

The sharp decline in long-dated US Treasury bonds was driven in part by continued rising concern over inflation, which as we have discussed previously is a key factor in the “digital gold” thesis propelling greater Wall Street crypto adoption.

Crypto markets continue to move very quickly with end of January figures already outdated. Both BTC and especially ETH have continued rocketing upwards to start February: as we go to press bitcoin is again approaching the $40k level and ETH is making new all-time highs each day. At present ETH is trading around ~$1,700, now well above its prior all-time high of ~$1,300 set in January 2018.

In addition to the GameStop firestorm perfectly illustrating the value of decentralization and censorship, on the 29th of January bitcoin received notable support from prominent innovator Elon Musk when he updated his Twitter profile to feature just the #bitcoin Twitter emoji.

As we go to press we will reiterate a point we made in our last monthly webinar on the 8th of January that led us to sound a short-term note of concern (proven correct the next day). Some of the traditional warning sign metrics that have signaled the potential for an overheated crypto market are starting to return, particularly another spike in USD dollar and stablecoin borrowing rates.

The massive boom we are seeing in the value of DeFi projects and tokens like Aave (AAVE) and Compound (COMP) is somewhat masking these high stablecoin borrowing costs.

For example, borrowers on the Compound protocol earn more COMP tokens as they borrow more of stablecoins like USD Coin and Tether. In other words, the “net rate” borrowers pay on a money market protocol like Compound is much lower than the pure stablecoin borrowing cost due to the boom in the price of COMP, which acts to subsidize the net borrowing rate.

Both AAVE, COMP and other DeFi leaders like UniSwap (UNI) have approximately tripled in value in just the last month.

Overall, we continue to be long-term bullish on DeFi and believe we are in the very early stages of building out what will ultimately serve as the future financial system “plumbing”.

However, a short-term loss of momentum in tokens like COMP could also cause a borrowing unwind that could negatively impact crypto prices. Further, a successful recent attack on a yearn.finance (YFI) stablecoin vault illustrates how DeFi is not without other risks.

2. On-Chain Analysis

Each month we dive into on-chain data to explore interesting trends or movements on the Bitcoin network.

Table 2: Month-over-month bitcoin network activity

Over the years, we have observed significant change in the type of on-chain transactions, which have become more efficient.

In our May 2020 outlook, we explained how some entities that started batching transactions resulted in a misleading decrease in the number of transactions, and we observed another increase in the number of transactions outputs in August.

As a result, in our October market outlook, we started to include the average daily number of payments as a more robust network activity metric than the number of transactions. We define a payment as the number of recipients receiving funds in a transaction, and that we estimate it by looking at the number of outputs in a transaction.

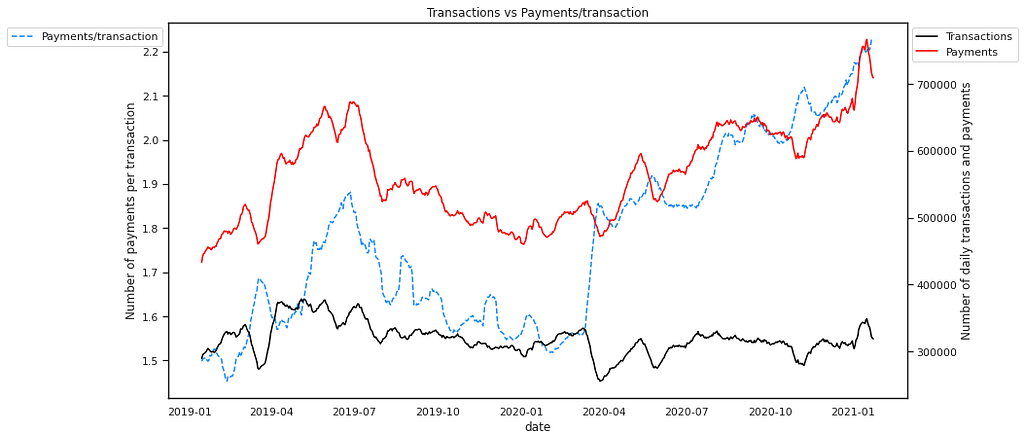

Figure 1 shows that the network participants are now creating more efficient transactions which results in an average of 2.2 payments per transaction, as opposed to 1.6 in early 2020.

More information about the methodology to estimate the number of payments

Due to the anonymity of bitcoin transactions with the use of addresses, the number of payments is not exact and should be estimated from the type of transaction. We have assumed that any transaction outputs is a payment, apart from one output being the change of the transaction when there is at least 2 outputs. For example, a transaction with 1 output is assumed to be 1 payment, and a transaction with 10 outputs is assumed to be 9 payments. This methodology can be improved, for example by detecting and removing payments from transactions consolidating UTXOs or entities moving funds from cold to hot storage.

Figure 1: The bitcoin network has become more efficient in processing payments

We are seeing a growing number of on-chain payments

January saw an increase in activity, with a 3.5% increase in the daily number of transactions, while the number of payments has had an even bigger increase of 8,7%.

As we can see in the Confirmed Payments Per Day chart, the number of payments that the network processes per day is at the highest since 2016. On the 7th January 2021, the network has confirmed more than 869,000 payments in a single day, which is even higher than the most active day of the 2017–2018 bull run which saw 860,000 payments confirmed on the 4th January 2018.

Is Binance Pool bringing centralization or decentralization?

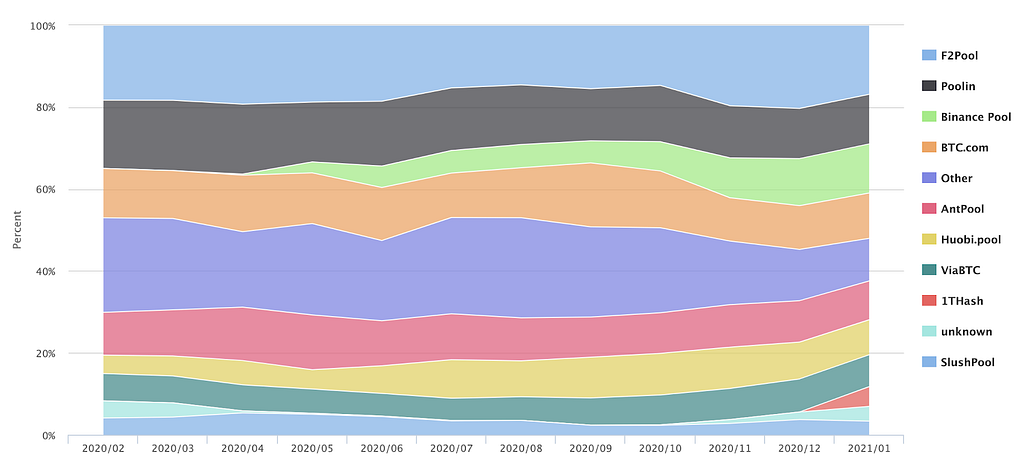

In April 2020, Binance launched its own crypto mining pool amid centralization concerns.

On one side, a new mining pool initiative brings more computing power, which is essential for the security of the network, and a diversified user base such as Binance customers brings decentralization in a way. On the other side, having the majority of mining split across few major mining pool feels like the network is controlled by a few entities.

As we approach a year since its launch the Binance Pool is now a top mining pool responsible for 12% of hash power. The other major mining pool F2Pool, Poolin, BTC.com and AntPool have kept their share, while smaller mining pools share (Others) has been halved less than a year (Figure 2).

Figure 2: Smaller miners and pools have lost half their hashrate share following the launch of the Binance Mining Pool

Source : https://btc.com/stats/pool

High fees could turn users to alternatives blockchains

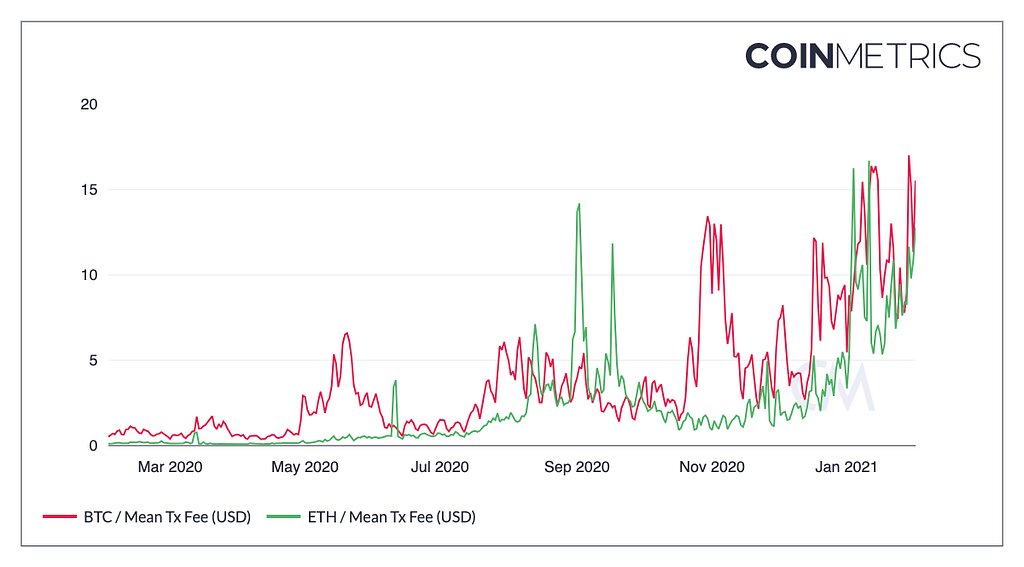

We are seeing days where the fees for sending a BTC or ETH on-chain transaction is averaging above $10, with fees sometimes greater than $30.

Not everybody can afford those fee rates, opening the door for cheaper alternatives.

Figure 3: Average ETH and BTC fee per transaction (in USD)

3. Spotlight on Polkadot (DOT) — Guest Post by Signum Growth Capital Team

One year into our role as Lead Advisor to the Web3 Foundation, we thought it was time to share our learnings on the Polkadot Network. You can find our primer linked below, which provides a “just the facts” overview of the new interoperability-focused blockchain network.

In addition to the factual background on the project, we believe there are a number of key themes worth noting, exploring, and discussing further.

5 Key Themes

1. The Polkadot Network is a Layer-0 Metaprotocol, not an “_____ — Killer”

After a decade of siloed blockchain development, the bulk of users, developers, and liquidity currently center around two networks and their ecosystems: Bitcoin and Ethereum. Addressing the lack of interoperability that has led to this concentration, the Polkadot Network offers an alternative vision for open blockchain protocols. As a metaprotocol, the role of the Polkadot Network is to host and secure other blockchain protocols. Other blockchains that build on top of it do not need to provide their own security guarantees, or construct their own interoperability bridges to other networks, as a result. The networks that connect to the Polkadot Network are referred to as parachains and can either be bridges to existing networks or Layer-1 networks in their own right. The Polkadot Network effectively provides a way for newly built blockchains to merge onto the highway of broader Web 3.0 internet infrastructure. This allows for digital assets and application logic to transcend any single blockchain and ensures that future technological developments will not splinter existing blockchain communities.

2. Customization is King

Blockchains of different designs and functionalities can connect to the Polkadot ecosystem without having to follow a specific architecture. This allows both open and permissioned blockchains to benefit from the same network effects, even if their structures are quite different. Considering that two-thirds of global enterprises surveyed by Deloitte in 2020 had concerns regarding their ability to implement blockchain solutions with proper data and compliance protocols, such an ability to customize will be critical in the wider adoption of blockchain networks in general. Moreover, the customization done by any one network can be submitted to a wider open-source library, making it progressively easier to launch new blockchains within the Polkadot ecosystem over time.

3. “Blockchain” will be Happening in the Background

We believe that the network tribalism that exists today between blockchain networks is misplaced, and that we will see a shift in competition away from the base layer to the applications themselves. This allows for uninterrupted growth of the ecosystem like growth the internet has enjoyed for three decades. Polkadot’s value proposition for a decentralized, privacy-protecting, and self-sovereign Web3.0 internet is well-positioned to be an arms provider to application growth. Future end users may understand more about the inner workings of the Polkadot Network than current end users understand about internet infrastructure when they send an email, but it will be out of interest, not necessity.

4. Positive-Sum Thinking will Define the Next Chapter of Blockchain Development

Polkadot makes blockchain development positive sum by aggregating resources around a singular agnostic interoperability protocol, ultimately unlocking a long tail of blockchain use cases. Just as economic globalization is facilitated by common business languages like English or Mandarin, even when they are not the native tongue of either party in a transaction, we believe interoperability is a key to facilitate wider blockchain adoption.

5. A Challenger to Big Tech

The Polkadot Network’s launch comes at a pivotal moment in the history of the Internet. The drumbeat against Big Tech has grown louder globally, and entering a new Presidential term in the US, there is growing support from all parties to expand antitrust enforcement against the giants. While Bitcoin and Ethereum have made incredible strides in disrupting money and financial services, they have not made us any less dependent on centralized tech platforms. For peer-to-peer blockchain networks to truly take on today’s corporate internet platforms, they will need a scalable alternative. The Polkadot Network appears to be well-positioned to attract the developers and users necessary to serve as the foundational layer for a decentralized internet future. The upgradability, modularity, and agnostic nature of the Polkadot Network make it the likeliest candidate to support a wider universe of other blockchain networks that has been bottlenecked by scalability and security limitations.

Read the full primer here.

4. What we’re reading and hearing.

Crypto

- Bitcoin Magazine: Ushering In A Bitcoin Standard: Marathon Buys $150 Million of Bitcoin

- Business Insider: Here’s why the approval of a US bitcoin ETF would send the cryptocurrency tumbling in the near term, according to JPMorgan

- Chainalysis: Alt-Right Groups and Personalities Involved In the January 2021 Capitol Riot Received Over $500K in Bitcoin From French Donor One Month Prior

- Coindesk: Harvard, Yale, Brown Endowments Have Been Buying Bitcoin for at Least a Year: Sources

- Grant Williams: Both Sides of the Coin: A Civilized Bitcoin Debate

- Intelligencer: What Explains Bitcoin’s Resurgence?

- Kaiko: North American Traders Dominate Bitcoin Markets

- Slashdot: Lost Passwords Lock Millionaires Out of Their Bitcoin Fortunes

- The Block: Chainalysis: The share of crypto transactions associated with criminal activity fell dramatically in 2020

- The Block: Wall Streeters won’t be able to ‘brush off’ Coinbase’s IPO like they do bitcoin, says Polychain CEO

- The Daily Gwei: #160 Unicorns or Sushi?

- The Defiant: Elastic Finance: Definition, Use Cases and Framework by AmpleSense DAO

Beyond Crypto

- Bloomberg: The dollar’s crash is only just the beginning

- CNBC: Another consequence of Covid: a world without cash

- Financial Post: How China won Trump’s trade warn and got Americans to foot the bill

- Financial Times: ECB to review format of private calls by chief economist of investors

- Financial Times: Higher inflation is coming and it will hit bondholders

- FiveThirtyEight: Nobody — And We Mean Nobody — Was Consistently Great Like Hank Aaron

- Market Watch: Fed’s Bullard says inflation may be ‘higher than we’re used to’ this year

- Project Syndicate: American Is the New Center of Global Instability

- Project Syndicate: Europe’s Vaccination Debacle

- Project Syndicate: The Quiet Financial Crisis

- Slashdot: Andrew Yang Proposes a Local Currency, Sees Growing Support for Universal Basic Income

- Slashdot: New Zealand’s Central Bank Says Its Data System Was Breached

- Slashdot: Uganda Orders All Social Media To Be Blocked

- Stratechery: Intel Problems

- Stratechery: Internet 3.0 and the Beginning of (Tech) History

- The Economist: Will India’s government act to save its public-sector banks?

- The Economist: Wikipedia is 20, and its reputation has never been higher

- VoxEU: Financial globalisation and inequality: Capital flows as a two edged sword

- VoxEU: Will inflation make a comeback as populations age?

Footnotes:

- Batching transactions is the process of grouping single transactions into a single big transaction by combining inputs and outputs. It has the benefit of reducing the total size it occupies on the blockchain, resulting in discounted fees for senders

When the Game Stops was originally published in @blockchain on Medium, where people are continuing the conversation by highlighting and responding to this story.