Taxation Without Representation: the Financial Repression Stealth Tax

A look at the winners and losers of financial repression

Quick Take:

- Of the various mechanisms for addressing growing government debt, financial repression is compelling from the perspective of policymakers

- Traditional savers and bondholders, such as banks and pension funds, are some of the biggest losers from financial repression

- The crypto industry and its users stand to be one of the biggest winners, along with holders of other hard assets

- Contrary to some recent prominent comments supporting the fairness of financial repression, any stealth tax by definition is neither fair nor democratic

“When you have eliminated the impossible, whatever remains, however improbable, must be the truth”

– Sir Arthur Conan Doyle, stated by Sherlock Holmes

Last month we wrote about how any sudden US dollar crisis could trigger a massive financial crisis. A key potential driver of any future run on the US dollar are growing concerns over unsustainable US government debts, which stand at levels not seen since the time of the Second World War.

Many were already concerned about world record levels of indebtedness prior to the COVID-19 crisis (myself included). Now the US and other countries are facing double-digit percentage fiscal deficits as governments grope with the ongoing pandemic and depression-level economic damage wrought by an unprecedented lockdown.

So far historically low interest rates have kept debt concerns in check. While markets and policymakers are forecasting low rates for the foreseeable future, and no mathematical formula exists to tell us precisely how much debt is too much, we know debt levels cannot continue growing at current rates indefinitely.

At some point debt growth rates must decline or there will be a painful reckoning.

How best to achieve sovereign debt sustainability?

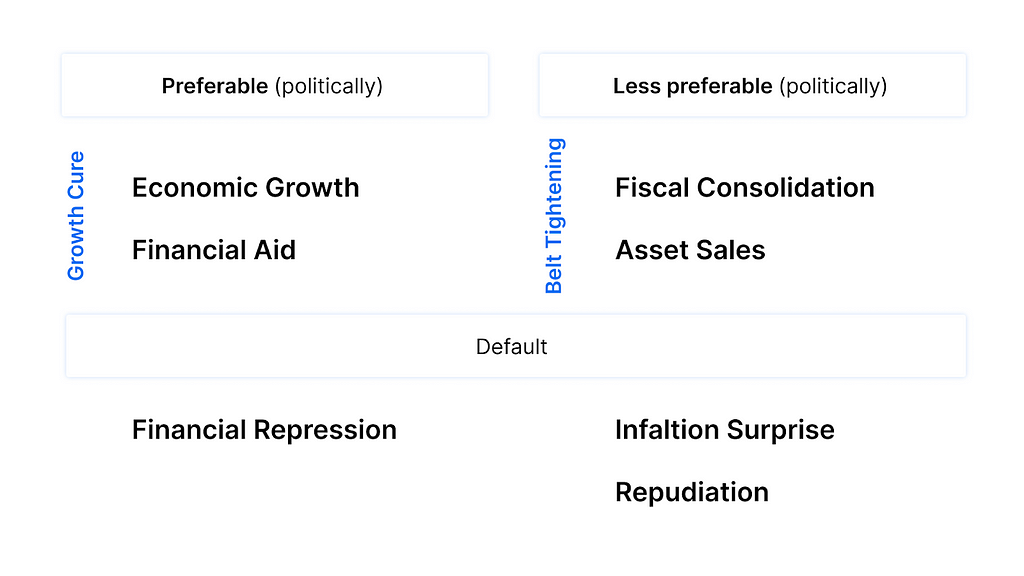

There are just seven distinct ways to address a public debt problem, each offering varying levels of political palatability (Figure 1).

Figure 1: Political preferences vary across the seven mechanisms for sustaining public debts

Growing out of a debt problem is the near universally preferred way to address overindebtedness. Similar to how strong store sales can bailout the manager of a retail shop suffering excessive shrinkage (theft) or other operational inefficiencies (the “sales cures all” principle in retail management), economic growth offers a trifecta of benefits:

- drives increased tax revenue (without requiring politically unpopular tax hikes).

- naturally reduces government spending on unemployment insurance and other automatic fiscal stabilizers.

- helps the bond market maintain confidence in the sovereign’s solvency, particularly if the economy’s growth rate remains above the government’s rate of interest on its debt.

But what happens if sufficient economic growth fails to materialize?

Pick your debt sustainability policy poison

After economic growth there is major dropoff in the political attractiveness or practicality of most of the remaining debt sustainability policy options:

- Fiscal consolidation: tax hikes can be one of the least politically popular moves a government can make to rebalance (arguments over who should pay more, how much more, etc.), while the years following the 2008 crisis demonstrated how spending cuts (austerity) can be just as politically painful.

- Financial aid: while grants or other unrestricted aid can be attractive, onerous loans or support from multilateral bodies like the IMF can be unwelcome as they typically come with strings attached, including micro-oversight and the aforementioned tax hikes and spending cuts.

- Asset sales: selling a country’s proverbial (or literal) crown jewels is an arguably underutilized tactic and can send a powerful signal to the bond market of the sovereign’s commitment to service debt, but selling assets can also be unpopular and lack credibility given the ability of governments to later expropriate domestic assets.

- Inflation: political thinkers as diverse as Keynes and Lenin agree (and history has frequently confirmed) that outsized inflation can lead to massive and catastrophic political upheaval. Any policymaker who chooses hyperinflation risks political suicide (or worse).

- Repudiation: the Greek debt crisis illustrated how even a relatively minor default (failure to pay interest and/or principal on schedule) can pose a systemic contagion threat and be blocked by creditors, and even relatively ancient defaults incurred under prior political regimes often remain unforgiven.¹

In the coming months and years some combination of the above policies may be implemented across various governments. For example, the UK Chancellor recently floated the idea of tax hikes, and some developing country foreign debt will probably need to be “restructured”, a euphemism for default.

Financial repression offers policymakers the debt sustainability path of least resistance

But there are mounting signs that policymakers will attempt to sustain massive government indebtedness in the US and elsewhere via financial repression.

Financial repression covers a wide range of multifaceted policies, but its key characteristic in advanced economies is artificially low or negative interest rates. These artificially low or negative interest rates help governments to continue servicing debts even in low-growth environments.

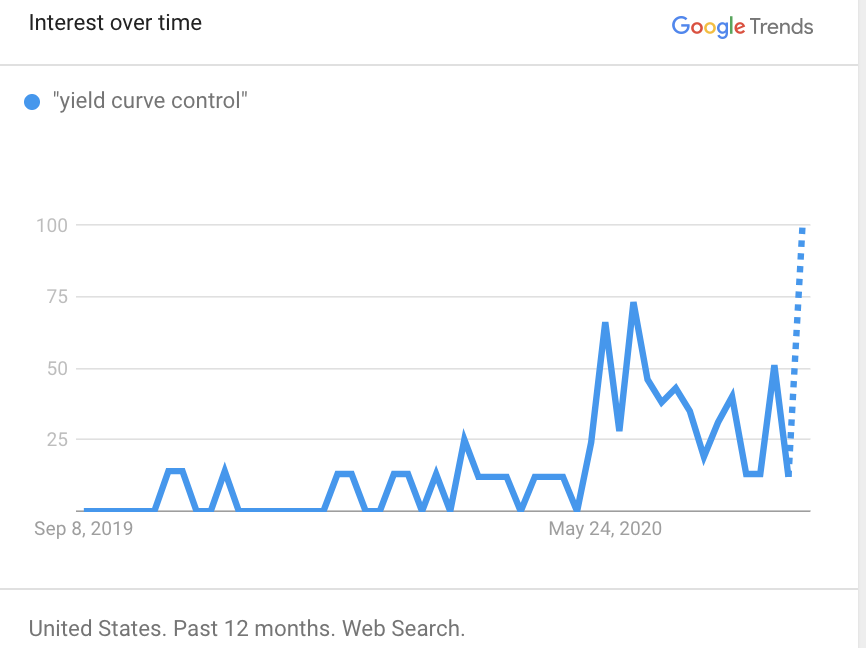

The preferred policymaker term for the artificially low interest rate aspect of financial repression is the much less sinister sounding “yield curve control”. While neither term is widely understood both are rising in use (Figure 2).

Figure 2: Google searches for “yield curve control” (aka financial repression) are on the rise

Part of the reason behind financial repression’s attractiveness to policymakers is its historical track record of aiding countries such as the US and UK in sustaining record levels of public debt following the Second World War. While the UK did suffer a number of serious financial crises and non-pecuniary defaults, both countries were able to avoid missing any interest and principal payments while also steadily decreasing their debt-to-GDP ratios from triple to double digits in the decades following the war.

But some, including World Bank Chief Economist Carmen Reinhart, offer a perhaps more cynical take on why financial repression is such an alluring debt sustainability policy for officials: it is a stealth tax.

Financial repression’s winners and losers

Financial repression often occurs alongside above norm inflation, making suppressed interest rates especially punishing for traditional savers, who struggle to earn sufficient yield via bank deposits and money market accounts to maintain purchasing power over time.²

These inflation-related losses are one element of what can be a very significant and hidden financial repression tax: a stealth transfer of economic value from creditors (e.g. traditional savers and bondholders) to debtors (e.g. governments).

While traditional bank savings account customers are often one of the biggest losers from financial repression, shareholders of commercial banks and other investment entities conscripted into holding government bonds are often another major casualty.

On a more positive note, crypto offers a solution to the liquidation of traditional bank savings deposits in the form of nascent crypto interest markets, which have grown rapidly in recent months to approximately $10 billion in size.

Some crypto lending markets currently offer double-digit annual interest rates on US dollar stablecoin deposits and sometimes even greater yields (and risks) via various DeFi (decentralized finance) protocols. Both the crypto industry and its users stand to be one of the big if not biggest winners from financial repression.

Other likely winners in a world of suppressed interest rates include owners of hard assets such as gold and real estate. Stock equity holders have also benefitted from low interest rates, and many believe stocks will continue to be attractive in such an environment.

Can a stealth tax be “fair”?

The main focus here has been to draw attention to why financial repression appears compelling from the perspective of policymakers, and to point out some of the economic winners and losers.

However, in a world with major gaps in financial and economic literacy the morality of financial repression also warrants attention, particularly in light of some prominent comments made recently supporting the fairness of financial repression.

For example, the normally excellent Gillian Tett of the Financial Times recently suggested that financial repression is the “fairest, most democratic way to actually get a debt burden reduced”.

But how can a stealth tax be considered democratic?

Gillian herself even uses the term “stealth transfer” in describing financial repression, so she is under no illusion about the hidden nature of the financial repression economic tax.

Based on my experience researching financial repression over the past decade it is my view that the vast majority of people have little to no idea what financial repression is, or how it operates. Those who are economically less literate and less well-off will be especially challenged to defensively position themselves in a financially appropriate manner.

More transparent taxation, openly debated in legislatures and passed through normal democratic processes, stands a much better chance of passing a fairness test than any stealth taxation orchestrated largely by unelected technocrats that heavily impacts smaller traditional savers.

Dr Garrick Hileman is a visiting fellow at the London School of Economics and the head of research at Blockchain.com, the leading provider of cryptocurrency solutions and creator of the world’s most popular crypto Wallet and the Blockchain.com Exchange. You can read more of his analysis and research on Twitter @GarrickHileman and @Blockchain.

Important note:

The research provided herein is for your general information and use and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation by Blockchain.com and is not intended to be relied upon by users in making (or refraining from making) any investment decisions. Appropriate independent advice should be obtained before making any such decision.

Footnotes:

- However, default can offer one significant domestic political advantage in cases where the debt is foreign owned.

- While standard consumer price inflation measures in the US and many advanced economies have remained tame for decades, the US has faced historically low interest rates for over a decade now. Quantitative easing has successfully kept interest rates at historically low levels, leaving some to characterize the past decade as one of financial repression. However, many of the other typical policy elements of financial repression, such as capital and other administrative financial restrictions, have not been expanded in advanced countries to the same degree as durng past eras of financial repression.

Taxation Without Representation: the Financial Repression Stealth Tax was originally published in @blockchain on Medium, where people are continuing the conversation by highlighting and responding to this story.