DeFi: Just Too Good to Be True? Can’t Take My Eyes Off of You

Can you really borrow money at negative rates, earn double-digit annual yields on savings deposits, and see 1000x token returns?

As excitement over DeFi continues it is useful to remember just how small a percentage of the population is currently participating in not just DeFi, but crypto as a whole.

Today, even as we approach this month the 12-year anniversary of the publication of the bitcoin white paper by Satoshi Nakamoto, crypto ownership and use remains in what can be reasonably characterized as the “early days”.

For example, in the United States, where crypto adoption appears to have first gained steam, it is estimated that crypto is owned by just ~5% of the population. While significant and equating to more than ten million individuals, that’s still a relatively small fraction of US citizens.

And within the world of crypto, participation in DeFi (shorthand for decentralized finance) is an even smaller number of people. For example, some of the most popular DeFi protocols count only tens of thousands of individual users.

Why aren’t more people using crypto and DeFi?

There is some overlap between the reasons given for why a relatively small percentage of people own crypto and participate in DeFi, including “lack of trust”, the second most commonly cited reason given in a New York Federal Reserve Bank survey of Americans on why people do not yet own cryptoassets.

This lack of trust may be in part due to the complexity of crypto and DeFi. But it may also be related to skepticism over some extraordinary claims about DeFi, including:

- borrowing at negative interest rates

- double-digit annual interest rates on savings deposits

- DeFi in some cases offering 1000x token returns in short order, which some prominent members of the crypto community said would never happen again

Do these claims hold up to scrutiny? Let’s take a look.

Can you really earn double-digit annual yields on savings?

This claim is one of the easiest for us to verify as factually correct as here at Blockchain.com we are currently offering the opportunity to earn 12% annually on US dollar denominated stablecoin deposits in our wallet.¹

Blockchain.com is also not alone in offering double-digit savings rates on US dollar denominated stablecoins (see here and here). And this is not an entirely new phenomenon either as double-digit rates have been available in crypto from at least last year (see here).

Now, over the past year there have been some sometimes significant fluctuations in crypto savings rates. And there are legitimate questions about how long such high savings rates can persist as more people embrace crypto lending.

But what we can say is that crypto savings rates a) have proven superior to traditional bank savings accounts and b) these superior rates have persisted for well over a year now and even risen higher of late in many cases.

Looking at the demand side for crypto borrowing, the trading of cryptoassets fuels a significant share of borrowing demand. As crypto continues to be more volatile than other asset classes traders should be willing to continue paying a premium to borrow cryptoassets.

Bottom line: even with a significant inflow of new crypto and DeFi participants I anticipate crypto deposit rates will remain superior to traditional savings rates for the forseeable future.

Can you really borrow funds at negative interest rates?

A perhaps even more incredible claim than earning double-digit interest rates is the suggestion that you can borrow funds — including US dollar denominated stablecoins — at negative interest rates.

For many, negative rates boggle the mind as completely unnatural and illogical (“you mean someone is going to pay me to borrow money from them?!? 🤯). This incredulity is evidenced by all the attention generated last year by the first negative interest rate mortgages in countries such as Denmark.

Not to be outdone, crypto markets have also created their own form of negative borrowing rates.

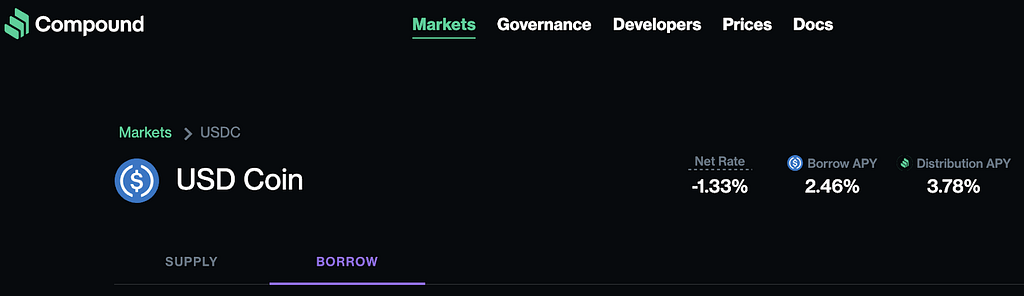

For example, today on money market protocols like Compound several cryptoassets, including USD Coin (USDC) and Ethereum (ETH), can be borrowed at a negative “net” rate (-1.32% and -1.85%, respectively at time of writing).

The way Compound users are able to borrow at a net negative rate requires an explanation as it is different from the Danish negative interest rate mortgage example, where borrowers see their mortgage balance reduced each month by more than the amount the borrower has paid back.

In the case of Compound, borrowers pay an initial positive rate of interest to borrow (the “Borrow APY”) akin to a traditional loan. However, this borrowing rate is lower than the effective yield earned on the pro rata distribution of new Compound tokens (COMP) received by the borrower for using the Compound protocol (the “Distribution APY”).

The difference between the “Borrow APY” and the “Distribution APY” is what is called the “Net Rate”, which is currently negative in the case of USD Coin and a few other assets available for borrowing on Compound at the time of writing.²

There are a number of other important differences between crypto lending markets and traditional lending, such as collateral rules.

Compound and many other crypto lending platforms currently require overcollateralization of loans. Where a mortgage borrower may only need to make a down payment of say 20% of a loan’s value, a crypto loan on Compound means the borrower must deposit collateral greater than the value of the loan.³ In this way crypto loans are more similar to home equity loans, where often the value of the loan is below the value of the collateral (home equity).

DeFi can offer 1000x token returns in short order

The fabled 1000x+ crypto returns seen by early holders of Bitcoin (BTC), Ethereum (ETH) and a small number of other crypto tokens launched in the past is something some, including Ethereum founder Vitalik Buterin, said would never happen again.

And yet this summer DeFi produced another 1000x token gain with the returns early yearn.finance (YFI) token holders saw a few short weeks after the token launched (Figure 1). Vitalik has gotten a lot right, but as happy early YFI token holders will attest he was wrong here.

Figure 1: yearn.finance (YFI) saw a 1000x+ gain with weeks of its launch this summer

Wrap-up

In crypto as in life, there are very good reasons to be skeptical when something appears too good to be true. It is important to understand the nascent nature of DeFi and recognize that there are risks across multiple dimensions (relatively new technology poses technical risk, potential volatility in interest and exchange rates, etc.).

However, in a world of zero and negative interest rates there are also risks with not exploring new ways to save and earn.

To be blunt, saving right now via a traditional bank account is a near guaranteed path to steadily seeing the value of your savings liquidated.

In contrast, DeFi and crypto offer not only the possibility of making a positive return, but as we have shown here a quite lucrative one. In short, you can believe some of the DeFi hype.

To help further demystify DeFi and crypto lending markets we will be sharing ongoing findings from our research in slides here and in future blog posts. Please follow-us on here on Medium or Twitter, or sign-up for a Blockchain.com wallet to be added to our email distribution list.

Dr Garrick Hileman is a visiting fellow at the London School of Economics and the head of research at Blockchain.com, the leading provider of cryptocurrency solutions and creator of the world’s most popular crypto Wallet and the Blockchain.com Exchange. You can read more of his analysis and research on Twitter @GarrickHileman and @Blockchain.

Important note

The research provided herein is for your general information and use and is not intended to address your particular requirements.

In particular, the information does not constitute any form of advice or recommendation by the author or Blockchain.com and is not intended to be relied upon by users in making (or refraining from making) any investment decisions.

Appropriate independent advice should be obtained before making any such decision.

Footnotes:

- For simplicity, in this section we are lumping together DeFi lending protocols and more traditional digital asset lending platforms (DALPs) like Blockchain.com. For a discussion of the difference between what is often defined as “DeFi” and DALPs see here.

- A couple further points worth mentioning about borrowing at net negative rates: a) negative net borrowing rates do not take into consideration any fees from transacting on the Ethereum blockchain (“gas”), converting COMP into another currency, etc., and these fees can be especially significant for smaller (eg < than $1,000) sums at present. b) the net negative borrowing rate is dependent upon the current exchange rate for the price of the COMP token earned by Compound’s borrowers and depositors (“liquidity miners”). In other words, any significant change in the price of COMP could significantly impact the net borrowing rate. c) while negative net borrowing rates on Compound have now persisted for some time, these rates are not fixed but rather are variable and can fluctuate (sometimes significantly) within a short period of time (eg during a single day). d) other risks and opportunity costs must also be considered (eg what risks do I incur from depositing funds into a smart contract protocol, what other returns could I earn from depositing collateral elsewhere, and so on).

- For example, a Compound user can borrow 60% of the value of wrapped bitcoin (WBTC) that the user has deposited into Compound (this means the “Collateral Factor” for WBTC is 40%). The WBTC deposited into Compound also earns interest and COMP tokens at a net annual rate of approximately 0.1% at time of writing. USD pegged stablecoins, because they are less volatile than bitcoin, can offer an even lower Collateral Factor than WBTC (eg 25%).

DeFi: Just Too Good to Be True? Can’t Take My Eyes Off of You was originally published in @blockchain on Medium, where people are continuing the conversation by highlighting and responding to this story.