Crypto Investment Thesis Redux

So much has changed in the past twelve months since we first published our general cryptoasset investment thesis, a 150-slide presentation examining the drivers and barriers to broadening ownership of cryptoassets such as bitcoin (BTC) and Ethereum (ETH).

With the COVID pandemic and ongoing economic fallout, along with developments within the crypto space such as the stablecoin boom and rise of crypto deposit interest income (DeFi, “yield farming”), we felt it was a good time to revisit the thesis to see how well it is holding up.

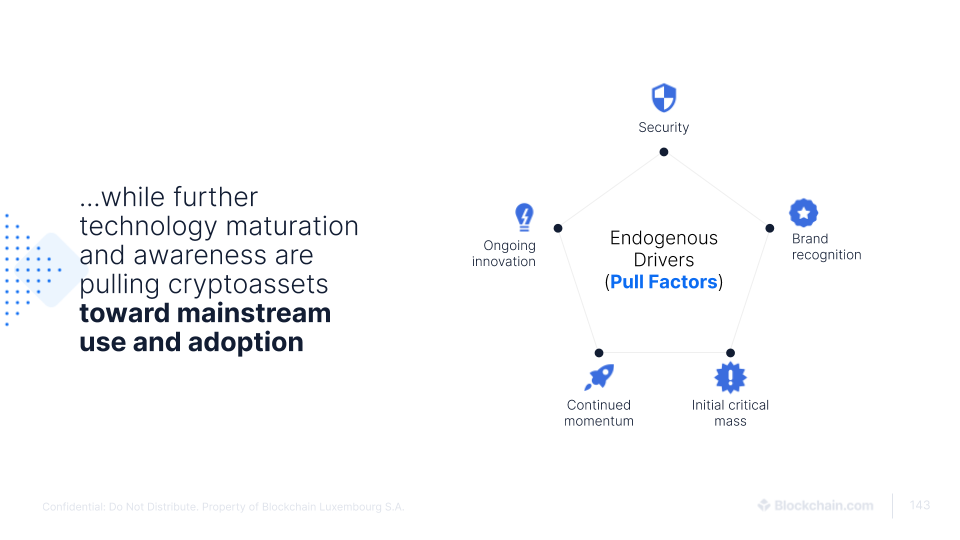

Overall, we believe you will find the thesis remains fresh and highly relevant for understanding some of the key “push” and “pull” drivers of ongoing crypto adoption, as well as areas of friction that continue to challenge widening crypto use and ownership.

Can Ethereum’s recent performance be sustained?

One ongoing development that may be shifting the crypto landscape is the strong performance of late of the Ethereum ecosystem.

For example, we have seen mining fee revenue for Ethereum close the gap and recently eclipse bitcoin, in significant part due to growing use of stablecoins like Tether (USDT) now riding atop Ethereum, along with the boom in DeFi. The price of Ethereum (ETH) has also significantly outperformed bitcoin in 2020. However, bitcoin continues to maintain a dominant market value share position (>60%) and ETH underperformed BTC in the year since we first published the thesis.

Continuation of the Ethereum ecosystem’s recent strong performance would meaningfully enhance the “pull” factors driving broader crypto adoption, alongside the relatively more mature and powerful “push” factors we focussed greater attention on in the thesis.

Investment Thesis Overview

Below are some key takeaways from the thesis. Be sure to tell us what you think in the comments.

Adoption growing towards critical mass

- Significant ownership levels, tens of millions of people now own crypto: we conservatively estimate at least 30–40 million individuals globally own cryptoassets like bitcoin (BTC), while some estimate ownership at >60 million; crossing the chasm from zero to tens of millions of users is arguably the “hardest part” in the ongoing journey of achieving mainstream adoption

- High growth rate: bitcoin adoption has grown faster than the PC and internet; user growth can be “lumpy”, but on average ~1 million new cryptoasset users have been added each month in recent years

- Inherently bubbly: In 2018, BTC experienced its sixth 70%+ price drop, but in 2019 the price rebounded +90%; periodic exuberance followed by large sell-offs attract significant media attention and appear to be endemic to widening adoption

- “It’s not going away”: bitcoin has been operating effectively uninterrupted for over a decade; many regulators and established firms now recognize that cryptocurrency and blockchain technology will underpin our future financial system

Endogenous and exogenous drivers support expanding crypto ownership

- Innovation: continued technical maturity, growing access and ease of use, and innovation (eg transaction speed and capacity)

- Demographics: ongoing shifts in demographics and preferences (eg millennial digital preferences) are favorable towards expanding crypto ownership

- Brand: growing crypto awareness; cryptoassets have been embraced by blue-chip companies such as Fidelity, New York Stock Exchange/ICE, CME, etc.

- Regulation: ongoing improvements to regulatory clarity; growing acknowledgement that crypto is here to stay

- Portfolio management: uncorrelated nature of crypto is attracting investors

- Political and economic environment: macroeconomic, financial and institutional dynamics are favorable for further growth in crytpoasset adoption

There are three main reasons to own crypto, but ‘Push’ factors dominate at present

Pull factors

- Next-generation financial plumbing (open/decentralized finance)

- Web 3.0 (decentralized internet)

Push factors

- Scarce store of value against macroeconomic and political risk (‘digital gold’)

The hardest asset in history is ironically virtual

A hard asset has traditionally been defined as a tangible or physical item, such as gold or silver, which has been used to hedge against fiscal and monetary expansion and resulting inflation.

Rising gold prices = increased total gold supply, which acts as a check on further gold price increases. In contrast, rising BTC prices ≠ increased total BTC supply

Bitcoin possesses a number of other advantages over gold:

- can be stored electronically at low cost

- quick, easy and relatively inexpensive to transfer ownership across space and time

- easily divisible (eight decimal places)

- authenticity verification can be performed quickly and easily

- programmability (eg smart contracts, smart escrow, etc.)

Bitcoin (BTC) continues to lead

BTC continues to dominate the cryptoasset landscape across key metrics:

- over $1 billion USD value of BTC is often transferred on-chain each day, more than all other cryptocurrencies combined

- off-chain self-reported exchange trading data has suffered from data reliability issues, but BTC continues to dominate here by most estimates

- BTC’s total computing power and miner fee income are an order of magnitude greater than all other cryptocurrencies combined

BTC’s use as a censorship resistant hard asset is the most developed crypto use case to date: the use of bitcoin as a scarce store of value against macroeconomic and political risk (“digital gold”) dominates at present, while other reasons for using crypto (eg DeFi, Web 3.0) are growing but still nascent

As goes the price of BTC, so goes the broader cryptocurrency market: cryptoasset prices continue to show very strong positive correlation (~90%); broader crypto market is unlikely to rally significantly higher without a higher BTC price

Transaction data and market structure point towards the next crypto bull market

More institution-friendly and balanced trading landscape: it has become much easier to “short” bitcoin and other cryptoassets; the availability today of regulated futures markets, as well as crypto borrowing and lending platforms, has created ways for traders to moderate irrational exuberance

Ongoing volatility: we do anticipate further outsized volatility, fueled in part by the growing availability of crypto borrowing and leveraged trading products

Return of the ‘Hodl’: significant selling by long-term owners during 2018-early 2019 has abated, on-chain evidence of renewed longer-term accumulation (‘hodling’)

Attractive time to invest: the price of BTC and many other cryptoassets are still well below their all time highs; while cryptoasset ownership penetration has grown significantly, the vast majority of people still do not yet own crypto for reasons we explore in the full investment thesis

Garrick Hileman is the head of research at Blockchain.com, the leading provider of cryptocurrency solutions and creator of the world’s most popular crypto Wallet and the Blockchain.com Exchange. You can read more of his analysis and research on Twitter @GarrickHileman and @Blockchain.

Important note:

The research provided herein is for your general information and use and is not intended to address your particular requirements. In particular, the information does not constitute any form of advice or recommendation by Blockchain.com and is not intended to be relied upon by users in making (or refraining from making) any investment decisions. Appropriate independent advice should be obtained before making any such decision.

Crypto Investment Thesis Redux was originally published in @blockchain on Medium, where people are continuing the conversation by highlighting and responding to this story.