Crypto and the US Election: The electoral voting system upgrade we desperately need

November Market Outlook

There is perhaps no better illustration than the 2020 US presidential election of the value of blockchain technology.

As we write we are now 3-days out from the completion of voting in an election that remains undeclared and contested. Slow, opaque voting systems have created openings for accusations of fraud and malfeasance. As the US descends into electoral acrimony there is no telling where our outdated voting technology will leave us.

Instead of the voting system we currently have, imagine a system where you were able to easily self-audit your activity to ensure your actions were recorded accurately.

Imagine being able to confirm results within minutes of an action taking place.

Imagine a system with robust security, resistant to hacking, and offering privacy protections.

Imagine a modern system not reliant on pen, paper, long travel times or in-person queues, and snail mail, but rather digital, convenient and mobile-device friendly.

Imagine a ledger of activity widely trusted as legitimate. A single source of truth.

Such a system is not just a dream. It already exists today for cryptocurrencies like bitcoin that leverage blockchain technology. And we should insist on something similar for our electoral voting system.

The numerous challenges associated with implementing electronic and blockchain based voting are not insignificant. But the next electoral voting system would do well to leverage core principles that underpin bitcoin and other blockchains:

- Auditability

- Censorship resistance

- Privacy

- Tamper resistance

- Speed

Summary

We’re pleased to offer you our latest thoughts on what’s driving crypto markets and analysis of bitcoin on-chain activity this month.

Be sure to also check out this month’s webinar presentation and podcast with Sam Harrison, who runs Blockchain.com Ventures.

- October Markets: Bitcoin boomed while long-dated Treasuries lost support

- For the month Bitcoin (BTC) and Ethereum (ETH) were up 28% and 6%, respectively, with Ethereum’s continued underperformance relative to bitcoin driven by a further slackening in DeFi momentum.

- Equities and gold were down for a second consecutive month at -2% and -1%, respectively, whereas the US dollar held onto last month’s gains and was unchanged.

- October saw a break in the strong correlation observed this year between stocks and crypto, generally viewed as a positive for crypto

- As of publication time bitcoin has set a new 2020 high of ~$16,000 and is at its highest levels since January 2018.

2. On-chain insights: Highlights from the Blockchain.com data science team

- Sharp decrease in hash rate to levels seen in April, perhaps due to annual Chinese miner Sichuan province migration to cheaper electricity regions

- Drop in hash rate occurred alongside a decrease in network activity, which may have been restricted due to slower block mining speeds

- October 31st saw the highest bitcoin transaction fees in two years, with an average fee of over $13 per transaction

- Non-custodial wallet activity increasing even as Paypal announces centralized approach to supporting cryptoassets

- The OkexPool has lost nearly all mining power, perhaps due in part to concerns over halts to Okex exchange withdrawals and the disappearance of the CEO

3. Discovering Institutional Demand for Digital Assets

- 36% of surveyed professional investors already have blockchain-inspired assets in their portfolio

- Majority of investors with exposure to cryptographic assets were primarily interested in bitcoin and ethereum

- Investors that have more bonds in their portfolio are less likely to invest in digital assets

4. What we’re reading, hearing, watching

1. October Markets: Bitcoin boomed while long-dated Treasuries lost support

In October crypto reversed course, with bitcoin in particular outperforming, turning in its best monthly performance since April up +28% for October (Table 1).

Table 1: Price Comparison: Bitcoin, Ethereum, Gold, US Equities, Long-dated US Treasuries, US Dollar (% Change)

Among the key driver’s of bitcoin’s outperformance was Paypal’s announcement of adding support for crypto for its over 300 million global users, and perhaps additional attention from the 12th anniversary of the publication of the bitcoin white paper. As we write bitcoin has set a new 2020 high of ~$16,000 and is at its highest levels since January 2018.

DeFi mania continued to cool, although Ethereum was still up +6% for October and appears to be gathering momentum as the long-awaited Ethereum 2.0 transition formally began.

Down for October were gold (-1%), equities (S&P 500 -2%), and long-dated US Treasuries, which suffered a significant sell-off (-4%). The US dollar managed to hold onto last month’s gains and was unchanged.

2. On-Chain Analysis

Each month we dive into on-chain data to explore interesting trends or movements on the Bitcoin network.

Table 2: Bitcoin network activity — October vs September

Network activity: A blend of multiple catalyzers

While Paypal’s new crypto services to buy, sell and hold will increase demand for bitcoins, the solution is highly centralized and inflexible. The percentage of transactions from the Blockchain.com non-custodial wallet increased by 4.7% in October, meaning that there is still a strong user base that value controlling their bitcoin private keys, allowing them to send and receive bitcoin without the need for a third party like Paypal.

Price volatility is usually correlated with an increase in transactions, but that was not the case in October. One reason for this low activity is the decrease in hash rate towards the end of the month which reduced the number of transactions that could be validated which in turn increased the fees.

The hash rate (bitcoin’s computing power) back to April levels

Towards the end of October, the estimated hash rate dropped almost 25% from 145 to 108 ExaHash/s (Figure 1). The bitcoin mining hash rate is a key security metric: the more hashing (computing) power in the network, the greater its security and its overall resistance to attack.

Figure 1: The estimated number of TH/s the bitcoin network is performing showing a sudden 25% drop towards the end of October, perhaps due to miners migrating to cheaper electricity

While a sudden and significant drop in hash rate could be concerning, some context helps place this particular drop in perspective. The majority of miners are mining from China, where there is an excess of electricity from hydropower during the rainy season (usually from May to September), making the electricity cheap and the mining activity highly profitable during that time. An article from The Block suggests that the migration from hydropower to fossil fuels energy is responsible for this drop.

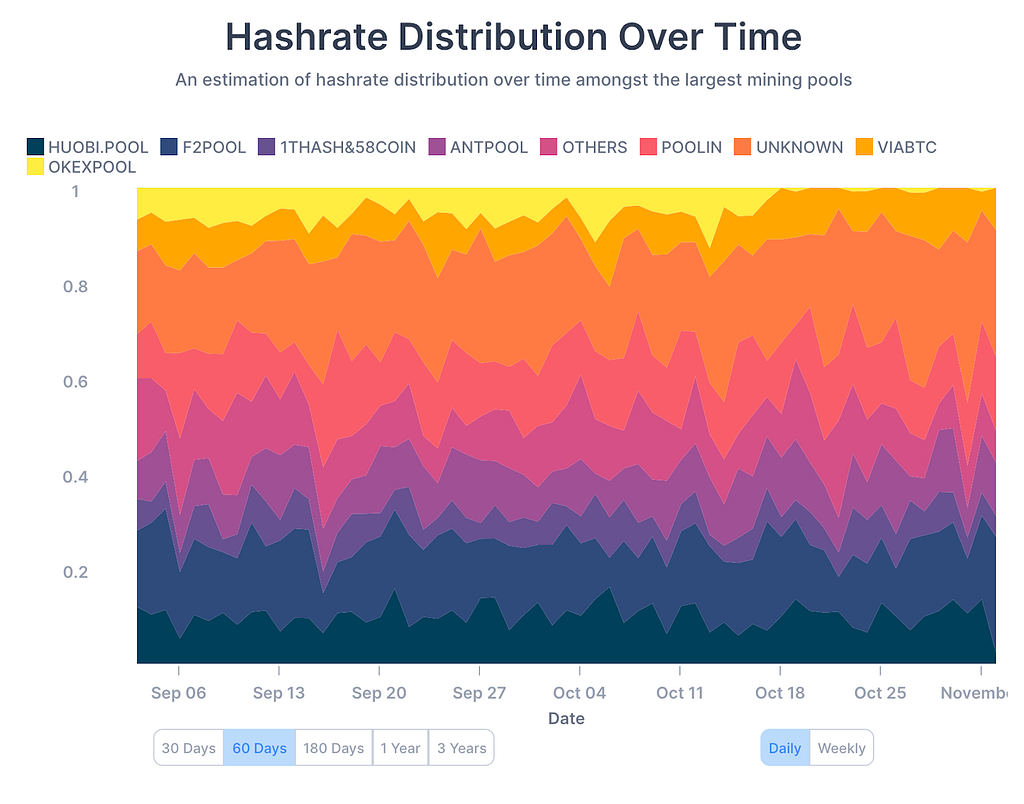

On a related note, OkexPool has lost nearly all mining power (see Figure 2). According to official figures, it dropped from 8.7 EH/s on the 15th of October to 0.3 EH/s on the 31st. This follows the arrest of Okex’s founder and exchange withdrawals halting, bringing uncertainty around the exchange. However, independent miners that previously contributed to OkexPool can continue their mining activity on their own or by joining another mining pool.

Figure 2: The hashrate Distribution over time shows OkexPool has lost nearly all mining power.

A significant increase in bitcoin fees per transaction

The 31st of October was the 12th anniversary of the bitcoin whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System” by Satoshi Nakamoto.

Ironically, it is on that day that the daily average fees per transaction reached a 2-years high (Figure 3). Days such as this demonstrate that bitcoin’s current “layer-1” cannot be the one and only solution for a global payments system, since only transactions with high fees could be confirmed on that day.

Figure 3: Fees per transaction (USD) reached a 2-years high of $13.20 per transaction on the 31st of October

On the other hand, Bitcoin is still remarkably efficient for “macro” payments. For example, this transaction on the 26th shows that over $1 billion in value can be transferred within minutes for the price of a cup of coffee (in this case $3.69 in fees). On a brighter note, network fees are directly paid to miners, so high fees attract more miners, which in turn increases network security.

3. Discovering Institutional Demand for Digital Assets

Guest feature by Demelza Hays, Director of Research, Cointelegraph

For years cryptocurrency permanent bulls have been saying that “this will be the year that institutional investors pile into Bitcoin”. Investors that hold cryptographic assets for speculation rather than for use as a medium of exchange hope to “front-run” Wall Street by buying in before bigger pockets enter the market. Putting the fear of missing out aside, there are genuine reasons to be excited about institutional investors joining the space. The sheer size of the wealth managed by institutional investors is enough to have a dramatic impact on the entire digital asset industry if there is entry.

To understand if there is really demand for institutional-grade and blockchain-inspired investment vehicles, Cointelegraph and the Crypto Research Report presented a landmark study on over 55 registered professional investors including pensions, insurance companies, banks, asset managers, and family offices. The report covered how much professional investors have already invested, how much they expect to invest over the next year, and what sectors of the industry are attracting the most investment. In juxtaposition to the perception of digital assets by investors with big pockets, the report covers the supply of investment vehicles in the crypto asset space by documenting what products exist, what their assets under management are, and what their historical returns have been.

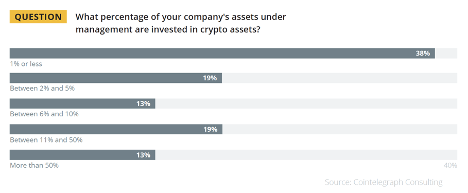

The 1990s Internet boom attracted labor talent and capital from all over the world to Palo Alto and California. In a similar fashion, the DACH region is one of the main hubs of blockchain innovation due to regulations built with the entrepreneur in mind, capital from investors, and banking access for crypto companies. That is why Cointelegraph and Crypto Research Report joined together to research the perception of digital assets by professional investors in the Germany-speaking regions. The total assets under management managed by the 55 asset allocators that participated in the survey was over €719 billion, which is more than double the entire market capitalization of the digital asset market. Out of those professional investors, 36% already had blockchain-inspired assets in their portfolio either through direct investment in cryptocurrencies, stablecoins, and security tokens or via funds, structured products, or futures.

This confirms the results of the survey done by Fidelity Digital Assets and Greenwich Associates earlier this year that found that 36% of the survey’s 774 respondents said they own cryptocurrencies or derivative products of cryptocurrencies. Out of the remaining 64% that have not yet invested, 39% plan to invest. This results in 61% of professional investors in the survey either already owning digital assets or planning to buy in the future.⁷

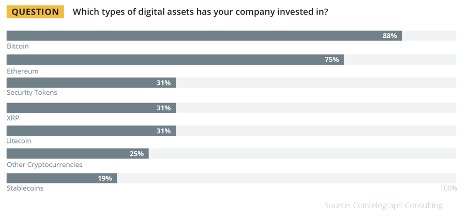

The majority of investors with exposure to cryptographic assets were primarily interested in Bitcoin and Ethereum. However, investors that are planning to invest, but have not invested yet, are primarily interested in Bitcoin and security tokens. Around 88% and 75% of respondents exposed to cryptocurrencies have invested in these cryptocurrencies, respectively. However, institutional investors appear to be increasingly interested in security tokens. Out of the 39% of investors that plan to invest in the future, security tokens were more popular than Ethereum and other alternative coins.

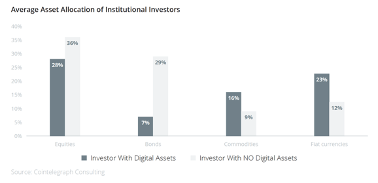

Interestingly, the survey also revealed the characteristics of professional investors that have decided to invest in digital assets or are planning to. The regression analysis shows that investors that have more bonds in their portfolio are less likely to invest in digital assets, ceteris paribus. This result was statistically significant with an alpha of .05. Investors who bought distributed ledger-based assets also had more commodities, and more cash reserves than their counterparts who did not have exposure to digital assets. This is in line with the ethos of the industry — lower trust in government bonds, higher trust in sound money, and growing cash reserves in expectation of a recession.

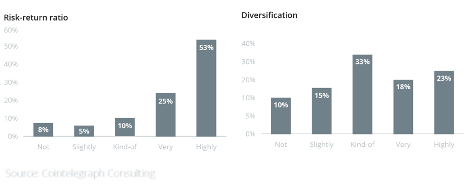

The respondents in the survey are managing at least €6 billion in blockchain investments or roughly 2% of the entire digital asset market capitalization. Notably, the firm’s size in terms of total assets under management was also found to be a statistically significant predictor of investment decision. Specifically, investors with more assets under management are less likely to invest in DLT-based assets. The majority of investors gained exposure to digital assets for the first time during the past two years. Nearly 31% of those surveyed invested in crypto assets in 2018 — after Bitcoin’s all-time high in mid-December 2017, when the price was almost $20,000 per coin and Bitcoin had a $334 billion market capitalization. According to the survey answers, the most important consideration for investing in digital assets is their risk-return ratio, as 53% of respondents rated this characteristic as “very important”. Most of the responses to “diversification” and “my company is convinced that the technology will be important in the future” are clustered in the middle and slightly skewed to the right of the importance spectrum, meaning that these factors are moderately important.

The survey has several results for asset managers who work with digital assets. First, there is a notable shift by professional investors away from altcoins and towards security tokens. This may impact the future price appreciation of cryptographic assets such as ETH, LTC, and XRP, because they may not attract as much investment from professional investors. Second, asset managers that are selling investment products with exposure to digital assets may wish to focus their marketing efforts on professional investors that do not have bonds as their largest allocation and are small and medium sized asset allocators, such as family offices, high net worth individuals, and private banks as opposed to pensions, insurance companies, and commercial banks.

Many banks stated that they would like to offer their clients the ability to buy and sell digital assets; however, the decision that needs to be made by the C-Suite executives is whether to build up their internal infrastructure or outsource the trading and custody to a third-party broker or exchange. For example, the Swiss giant in core banking systems, Avaloq, was mentioned multiple times by respondents. Avaloq is offering trading and custody solutions for investing in digital assets. If a bank buys the Avaloq digital asset module, the ability to invest in digital assets could be expanded to the bank’s entire customer base, and retail clients would even be able to buy and sell via their e-banking and mobile-banking applications. However, the banks said they are hesitant to purchase software solutions to bring digital asset investing to their clients. The infrastructure and services are considered to be too expensive still. Custody solutions in particular are comparatively expensive. The main reason for this is believed to be a lack of competition. The banks would need to have significant demand for digital assets from their clients in order to justify the expense. As more traditional players enter the digital asset industry, prices should fall in this regard.

The survey was delivered via email to all registered professional investors with BaFin (Germany), FMA (Austria), FINMA (Switzerland), and the FMA (Liechtenstein) between the months of June to September of 2020. With the help of local banking associations, the survey was also sent out to the members of the BVI Deutscher Fondsverband and BAI in Germany, a subgroup of members of SFAMA in Switzerland, and the Liechtensteinischer Anlagefondsverband. The majority of the respondents came from Switzerland (16) followed by Austria (10), Germany (7), and Liechtenstein (6). When sorting the survey results by country, the respondents from Switzerland managed the most assets with €278 billion. Austria’s respondents worked in firms with the highest headcount. The majority (83%) of the respondents worked in firms with less than 50 employees.

There is still unmet demand for financial services and products. Survey results indicate that investors would be willing to pay for insurance for the loss of private keys if such products existed. Additionally, investors mentioned the desire to invest in blockchain-based venture capital funds and derivatives, although few products exist on the market currently.

To read the 70+ page research report written by eight authors and supported by SIX Digital Exchange, BlockFi, Bitmain, Blocksize Capital, and Nexo, visit Cointelegraph.

Demelza Hays is the director of research at Cointelegraph, Forbes 30 Under 30, U.S. Department of State Fulbright Scholar, and former fund manager of two regulated crypto funds. She is also completing her Ph.D. in Business Economics at the University of Liechtenstein.

4. What we’re reading, hearing, and watching.

Crypto

- Bitcoin Magazine: Introducing CBPI: A New Way To Measure Bitcoin Network Electrical Consumption

- Coin Center: Tangents from Coin Center: Daniel Buchner

- Coindesk: The Inevitability of ‘Big Blockchain’

- The Block: YFI found Andre Cronje clarifies his famous ‘test in prod’ approach

- Vice: Iran is Pivoting to Bitcoin

- Wired: Blockchain could soon make it impossible to sell a stolen Rolex

Beyond Crypto

- BBC News: UK inflation rises after Eat Out to Help Out ends

- Financial Times: The debt bubble legacy of economists Modigliani and Miller

- GQ: The Mystery of the Immaculate Concussion

- Netflix: Challenger: The Final Flight; Episode 3 (useful engineering and management case study of the O-ring review/discussion between NASA and Morton-Thiokol)

- The Economist: Low interest rates leave savers with few good options

- The Prof G Show: Cold War II: China Tech vs. US Tech

- The White House: Remarks by Deputy National Security Advisor Matt Pottinger to London-based Policy Exchange

Important note

The research provided herein is for your general information and use and is not intended to address your particular requirements.

In particular, the information does not constitute any form of advice or recommendation by Blockchain.com and is not intended to be relied upon by users in making (or refraining from making) any investment decisions.

Appropriate independent advice should be obtained before making any such decision.

Footnotes:

- Average daily number of confirmed transactions in the public blockchain

- Average daily number of confirmed transactions sent from our Blockchain Wallet and API

- Average daily number of unique addresses used as inputs and outputs in the confirmed transactions

- Average daily number of estimated payments in the public blockchain

- 0.3929*0.64=0.251456, therefore, a total of 36% + 25.15% = 61.15%.

Crypto and the US Election: The electoral voting system upgrade we desperately need was originally published in @blockchain on Medium, where people are continuing the conversation by highlighting and responding to this story.