Coinbase priced its offering of $1.25B

Coinbase priced its offering of $1.25B of Convertible Senior Notes for long term growth and expansion

Yesterday we announced the pricing of $1.25 billion aggregate principal amount of Convertible Senior Notes. We wanted to take this opportunity to share our thought process behind this capital raise.

We believe this capital raise represents an opportunity to bolster our already strong balance sheet with low cost capital that maintains operating freedom, minimizes dilution for Coinbase’s stockholders and expands our ability to fuel innovation and growth regardless of market conditions.

Coinbase is in a strong financial position. We have been fortunate to be profitable historically on an Adjusted EBITDA basis and ended Q1 2021 with nearly $2 billion in cash and cash equivalents on our balance sheet. With this backdrop, we have the ability to access additional capital on an opportunistic basis.

The cryptoeconomy is growing at an incredible rate. Crypto market capitalization reached nearly $2 trillion at the end of Q1 2021 compared to $782 billion at the end of Q4 2020. Underpinning this growth is expansion in all aspects of the cryptoeconomy: DeFi, NFTs, global interest in crypto, new market entrants, and new products and services. In order to deliver the best crypto experiences and provide more users access to the cryptoeconomy, we believe it is prudent to further strengthen our balance sheet and ensure we have the resources to execute on our mission and opportunities.

We have taken a thoughtful approach to our capital structure over the years. Our goal has been to raise capital at the lowest cost possible to our shareholders. We pursued a direct listing primarily as we felt it most closely matched the ethos of crypto by providing more open access and transparency with market-driven price discovery but a secondary driver was to avoid the relatively high cost of capital and dilution associated with traditional initial public offerings.

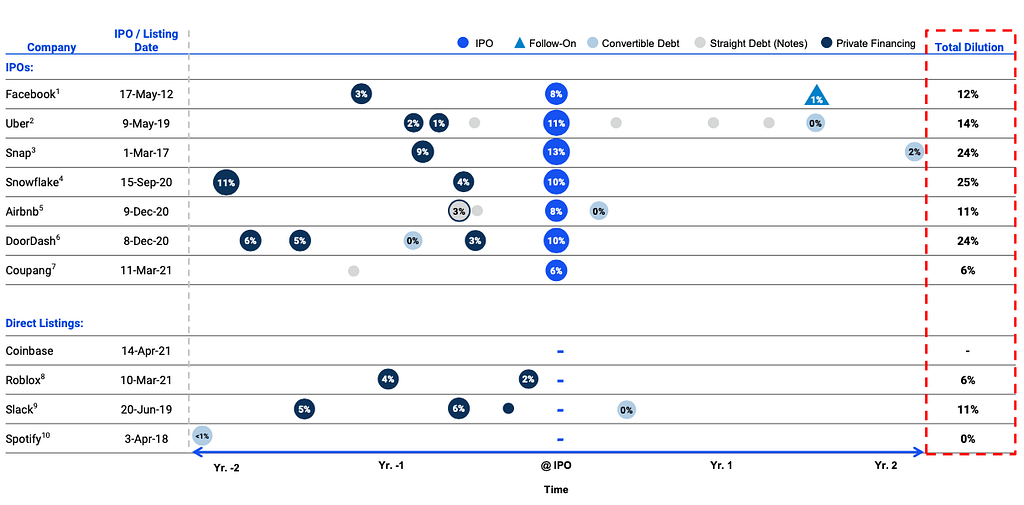

We have chosen to issue convertible notes as we believe doing so offers a low total cost of capital, operating flexibility and minimal dilution for shareholders. Additionally, we entered into capped call transactions with certain financial institutions, which are derivative transactions that are structured to reduce potential dilution and/or offset cash payments made upon conversion of the notes. The combined terms of our convert and capped call result in a maximum of 1.15% potential dilution that our shareholders could experience in the next 5 years (assuming the full greenshoe is exercised, as explained in footnote 11 below). When you compare total dilution from the combination of transactions, we believe that our capital market activities place us at the low end of the range in terms of potential dilution to shareholders relative to other large and high growth technology companies (see chart below for other company examples).

History of Financing Activity by Comparable Large Technology Companies

(two years prior to going public through two years post going public)

In closing, we believe this capital raise puts us in a strong position to fuel growth and expansion and take advantage of the opportunity ahead of us.

Cautionary Statement Regarding Forward-Looking Statements

This blog post contains “forward-looking statements’’ including, among other things, statements relating to the completion and size of a proposed convertible note offering, the potential dilution from the offering, and the expansion and other trends of the cryptoeconomy. Statements containing words such as “could,” “believe,” “expect,” “intend,” “will,” or similar expressions constitute forward-looking statements. These forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements involve risks and uncertainties that could cause actual results to differ materially, including, but not limited to, whether or not Coinbase will offer the notes or consummate the offering, the final terms of the offering, prevailing market conditions, the anticipated principal amount of the notes, which could differ based upon market conditions, or for other reasons, the impact of general economic, industry or political conditions in the United States or internationally, including the impacts of the COVID-19 pandemic, and whether the capped call transactions will become effective. The foregoing list of risks and uncertainties is illustrative, but is not exhaustive. For information about other potential factors that could affect Coinbase’s business and financial results, please review the “Risk Factors’’ described in Coinbase’s Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2021, filed with the Securities and Exchange Commission (the “SEC”) and in Coinbase’s other filings with the SEC. Except as may be required by law, Coinbase undertakes no obligation, and does not intend, to update these forward-looking statements after the date of this release.

This post is neither an offer to sell nor a solicitation of an offer to buy any of the notes or any shares of Class A common stock potentially issuable upon conversion of the notes and shall not constitute an offer, solicitation, or sale in any jurisdiction in which such offer, solicitation, or sale is unlawful.

Notes to History of Financing Activity by Comparable Large Technology Companies

Source: Public Filings and other publicly available sources; market data as of May 18, 2021

1 Facebook pre-IPO dilution calculated as primary capital raised as a percent of post-money valuation. IPO dilution reflects a primary offering of 180m shares at $38.00 and is calculated as primary capital raised as a percent of post-money valuation. Dilution from Facebook’s follow-on is calculated as a percent of market capitalization at issuance and excludes dilution from secondary sales.

2 Uber pre-IPO dilution calculated as primary capital raised as a percent of post-money valuation. Uber pre-IPO debt reflects $2.0bn raise in Oct-2018. IPO dilution reflects primary offering of 180m shares at $45.00 and is calculated as primary capital raised as a percent of post-money valuation. Uber converts reflect no dilution based on a conversion price of $80.84, which is currently above the stock price of $49.17 as of May 18, 2021.

3 Snap pre-IPO dilution calculated as primary capital raised as a percent of post-money valuation. IPO dilution reflects primary offering of 145m shares at $17.00 and is calculated as primary capital raised as a percent of post-money valuation. Post-IPO convertible debt reflects 2% dilution based on a current stock price of $53.36 as of May 18, 2021 which is above the exercise price of $32.58 of the associated capped call transaction. Snap converts issued in 2020 and 2021 are not included since they are outside the two year post-IPO period.

4 Snowflake pre-IPO dilution calculated as primary capital raised as a percent of post-money valuation. IPO dilution reflects primary offering of 28m shares at $120.00 and is calculated as primary capital raised as a percent of post-money valuation.

5 Airbnb pre-IPO dilution reflects the issuance of warrants with an exercise price of $28.36 in connection with the second lien loan from Apr-2020. IPO dilution reflects primary offering of 50m shares at $68.00 and is calculated as primary capital raised as a percent of post-money valuation. Post-IPO convertible debt has no dilution due to an associated capped call transaction with a cap price of $360.80, which is currently above the stock price of $135.02 as of May 18, 2021.

6 DoorDash pre-IPO dilution calculated as primary capital raised as a percent of post-money valuation. Dilution from pre-IPO convertible debt is 0% as the company repaid the principal amount in full in February 2021. IPO dilution reflects primary offering of 33m shares at $102.00 and is calculated as primary capital raised as a percent of post-money valuation.

7 Coupang IPO dilution reflects primary offering of 100m shares at $35.00 and is calculated as primary capital raised as a percent of post-money valuation. 8 Roblox pre-IPO dilution calculated as primary capital raised as a percent of post-money valuation.

9 Slack pre-IPO dilution calculated as primary capital raised as a percent of post-money valuation. Slack post-IPO convertible debt reflects no dilution due to an associated capped call transaction with a cap price of $48.62, which is currently above the stock price of $41.22 as of May 18, 2021.

10 Spotify pre-IPO convert dilution based on private financing from select investors. Conversion price reflects the assumption that investors convert the debt to equity at a 20% discount to Spotify’s listing price with a step up of 2.5% every extra six months beyond a year that the company waits to go public from the time of investment in Mar-2016. Spotify’s Q1 2021 convert issuance is not included since it falls outside the two year post-IPO period.

11 Represents maximum potential dilution based on our offering of $1.44 billion aggregate principal amount of Convertible Senior Notes Due 2026 (assuming the full exercise by the initial purchasers of the option to purchase additional notes), the initial cap price of the capped call transactions of $478.00 per share and our fully-diluted share count as of May 18, 2021. This fully diluted capitalization share count includes the shares of common stock outstanding and all outstanding stock options and restricted stock units but does not include shares of common stock reserved for future issuance under Coinbase’s equity compensation plans or its Pledge 1% commitment.

Coinbase priced its offering of $1.25B was originally published in The Coinbase Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.