Bazookas, Bailouts, Bitcoin: Crypto in the Time of COVID-19

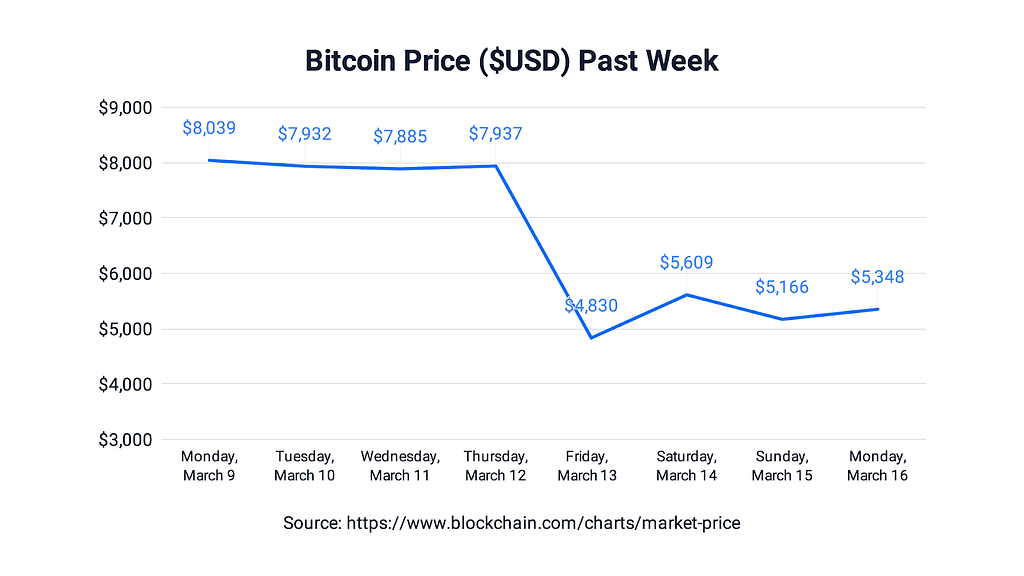

This last week we saw significant price declines and volatility across the entire crypto sector, with bitcoin’s price dropping approximately 50% over the course of Thursday and Friday. Investors in crypto — as well as the broader financial markets — are understandably rattled by the rising impact of the COVID-19 virus globally, and the negative response so far from markets.

In times of significant uncertainty it is important to focus on facts, and to question unsupported opinions. Looking at history can also often be helpful, including recent history like the 2008–2009 financial crisis, during which bitcoin emerged.

Through that lens, what can the history of crypto, and economic history more broadly, tell us?

The six main takeaways we cover in this blog:

- Bitcoin’s large price decline last week was unusual, but not unprecedented.

- Claims that crypto has “failed”, or that the crypto ecosystem “broke”, are overblown and do not hold up to scrutiny.

- Outsized volatility in cryptoasset markets should be expected and is not necessarily a “bad thing”.

- Heralding the death of bitcoin as “digital gold”, or claiming that bitcoin will never be a “safe haven”, is premature.

- How crypto will perform in the near-term as the COVID-19 crisis plays out is unclear, but we continue to expect many of crypto’s attributes to prove attractive in the years to come.

- Concerns over COVID-19, as well as the nearly certain prospect of future viruses, will provide a secular boost to digital payments, cryptoassets, and other uses of blockchain technology.

Bitcoin’s large price decline last week was unusual, but not unprecedented.

- We have to go back more than six years to December 2013 — when bitcoin’s price dropped approximately 50% in a single day — to find the last time we saw such a large price decline in such a short period.

- While last week’s large price drop was speedy and significant, it was less than bitcoin’s top-5 all-time price declines (measured from peak to trough). Bitcoin experienced two previous price declines of over 90%, and from its December 2017 high of over $19,000 USD bitcoin’s price dropped by over 80% to a low of ~$3,200 USD in mid-December 2018.

- Bottom line: cryptocurrency markets have experienced worse, and in some cases much worse, than what we saw last week.

Claims that crypto has “failed”, or that the crypto ecosystem “broke”, are overblown and do not hold up to scrutiny.

- While significant congestion issues temporarily plagued the Ethereum ecosystem, the vast majority of blockchain networks continued to facilitate transactions normally and without a hiccup, just as they have in the case of bitcoin for the past 11+ years.

- Upgraded and improved crypto business infrastructure also largely performed better than during past periods of market stress (e.g. with one notable exception, major crypto exchange uptimes significantly improved from prior periods of outsized market volatility in 2017).

- The core features and qualities that brought many people to crypto and blockchain technology remain intact: open access, censorship resistance and trust minimization, relatively low cost and speedy global electronic payments, limited and predictable currency supply, transparency and open source code, programmable value transfer and smart contracts, etc.

- Bottom line: a long and ignoble list of incorrect pronouncements about the death of bitcoin and cryptocurrency have accrued, and we expect these latest ones to be added to the historical record.

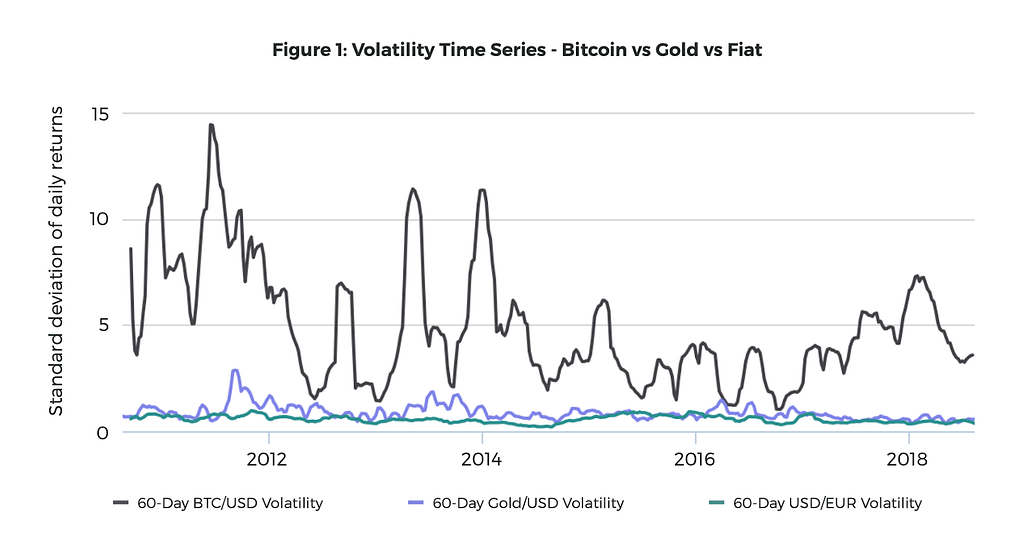

Outsized volatility in cryptoasset markets should be expected and is not necessarily a “bad thing”.

- Unlike most traditional financial markets, crypto markets operate 24 hours a day, 7 days a week and do not have circuit breakers; these and other factors have historically made crypto significantly more volatile that traditional financial assets and currencies.

- In recent years leveraged crypto investing has grown in popularity, and the rapid unwinding of leveraged positions can create very volatile market conditions; this phenomenon appears to have played a key role in last week’s price action, where a series of cascading liquidations occurred on BitMEX.

- It is also important to recognize that volatility is not necessarily a “bad thing”; outsized volatility has often been considered “a feature, not a bug” and has arguably played an overall positive role in the growth of crypto.

Heralding the death of bitcoin as “digital gold”, or claiming that bitcoin will never be a “safe haven”, is premature.

- Claims that crypto is no longer uncorrelated with traditional markets based on a few days of data during a liquidity shock is unwarranted; indeed, for many bitcoin’s price response to last week’s liquidity shock was not surprising and was anticipated well in advance.

- During times of crisis, other so-called “safe haven” assets have also experienced sell-offs and retained their safe haven status.

- Gold has recently experienced a significant price decline; it also experienced a major correction at the start of the 2008 financial crisis, and it is still generally viewed a safe haven asset.

- Even the world’s largest and deepest market, the US Treasury market, was disrupted last week, with prices declining alongside equities at various times; the highly unusual disruption seen in US Treasury markets was cited as a primary justification for the Fed’s Sunday-night “bazooka”.

- Safe havens can also see large total price declines over time; during the last decade gold dropped approximately 40% from its all-time high.

- Bitcoin’s response to a liquidity and deleveraging crisis, like we saw last week, resembles how gold performed initially during the 2008 financial crisis when it matched the S&P 500’s 17% decline in October 2008.

- As with other financial assets, it is important to be cautious when trying to explain price moves; crypto markets are still relatively new and have their own idiosyncrasies; prices go down for one simple reason — when supply offered for sale outstrips demand; there can be numerous and difficult to pinpoint reasons for why that occurs.

How crypto will perform in the near-term as the COVID-19 crisis plays out is unclear, but we continue to expect many of crypto’s attributes to prove attractive in the years to come.

- Crypto is still a relatively new asset class; it has never been through a pandemic or global financial crisis and we simply do not know for sure how it (or other traditional assets, for that matter) will perform in this environment over the near-term.

- However, as central banks and monetary policy push even further into unprecedented territory, and massive government fiscal expansion continues, there are growing reasons to be concerned about a future financial crisis (we cover this in our general crypto investment thesis and will break down the COVID-19 specific response in an upcoming blog).

- Concerns over financial stability may be especially true in emerging and developing countries, which have seen relatively higher public and private sector debt growth in the last decade. From 1970, all three major emerging market debt waves ended in financial crisis. It would seem unlikely that “this time is different”.

- During periods of financial instability investors will often seek out hard assets, like gold. From a hard asset perspective, bitcoin offers a number of complementary and superior features to gold including its digital nature (which aids payments and storage), ease of divisibility, and finite supply.

- Former-IMF chief economists recently said the world is now in recession, and hard assets have traditionally performed well around the time of recessions.

- After falling initially in the 2008 financial crisis, gold more than doubled over the next several years to set a new all-time high; it is our view that bitcoin and cryptoassets are generally well positioned to also chart an upward trajectory in the months and years to come.

- At the same time, we do not always expect bitcoin and other cryptoassets to trade in lockstep with other hard assets like gold. Bitcoin is still relatively small in terms of market value (~$100 billion USD) and liquidity, and has historically followed its own unique price cycles. Unlike mature assets such as gold, we believe cryptoassets have significant room for growth.

- We expect bitcoin specifically to increasingly trade as a macro asset over time, but we do not expect that behavior consistently today.

Concerns over COVID-19, as well as the nearly certain prospect of future viruses, will provide a secular boost to digital payments, cryptoassets, and other uses of blockchain technology.

- Quarantines of physical cash are further fueling declining use of banknotes and coins, and driving calls for increased use of digital and contactless payments.

- The virus is demonstrating the value of alternative and redundant-backup systems for critical infrastructure, such as storing and moving value.

- It further supports adoption of many non-currency uses of blockchain technology, such helping people navigate fake news, food supply chain tracking, e-voting, etc.

At Blockchain.com, we’ve seen a lot happen in the global financial markets and in crypto since our founding back in 2011. While there’s a fair amount of uncertainty in the world today, we’re reminded that it is exactly moments like these why we created the company in the first place. We believe in creating a financial system for the internet that empowers anyone in the world to control their money. Our experience makes us confident that the still-emerging crypto ecosystem will not only weather this storm, but emerge stronger than ever before.

Interested in getting started in crypto? Sign up for a free Blockchain.com Wallet or trade on the Blockchain.com Exchange; we’re here for you.

If you have any questions please do not hesitate to get in touch.

For more insights from our research team, go to our Research page and follow our Head of Research, Garrick Hileman on Twitter.

Bazookas, Bailouts, Bitcoin: Crypto in the Time of COVID-19 was originally published in @blockchain on Medium, where people are continuing the conversation by highlighting and responding to this story.