Battle Testing Bitcoin: The 2020 Halving Post Mortem (Part 1)

Placing the halving’s impact on network security in context

This week the “Super Bowl of crypto” — the quadrennial halving of the Bitcoin (BTC) mining block reward — has once again come and gone. Not surprisingly, the 2020 halving itself — the moment where the mining reward was cut down to just 6.25 coins — was just as anticlimactic (in a good way) as prior halvings.¹

(If you are still new to bitcoin and/or don’t understand “the halving”, you are in good company! We have a brief explainer in the footnote at the bottom.²)

Each of these halvings represents a form of “quantitative tightening”, so to speak, on the supply of new bitcoins.

Billions of people still don’t understand what the bitcoin halving is, why it is so important, and what comes next

Much of the excitement about the halving has to do with anticipating the impact of this reduction in new coin supply on bitcoin’s price, which has historically performed extraordinarily well both before and after halvings (Figure 1).

Figure 1: BTC price performance before/after mining reward “halvings”

Another reason why these halvings attract so much attention is they highlight what is arguably bitcoin’s single most compelling design characteristic: scarcity. Without bitcoin’s reliable digital scarcity — maintained by a decentralized network rather than a single institution or individual — bitcoin would fail.

The halving is also relevant to not just bitcoin, but the crypto ecosystem as a whole. Bitcoin continues to dominate the crypoasset landscape, with bitcoin representing more than 70% of the total market value of all cryptoassets. In other words, as goes bitcoin so goes the broader world of crypto.

Network security is foundational to bitcoin’s existence and success

The fact that the price of bitcoin gets the lion’s share of attention is at least partly because bitcoin has proven so reliably secure at the protocol and network level for more than a decade. Securing personal cryptoasset holdings also receives more attention than network level security, and for good reason.

While it is true that bitcoin’s price and security are closely intertwined, the absence of reliable network security would undoubtedly negatively impact bitcoin’s price (perhaps catastrophically). Robust network security is bitcoin’s most essential feature.

In 2011 Blockchain.com coined the term “hash rate” to define the amount of total computing power that is estimated to secure the bitcoin network. Bitcoin network security has many different elements, but the hash rate level is one of the most important. In short, the more hash rate (computing power) the greater the level of bitcoin network security and resilience against 51% attacks.³

Following a halving, if bitcoin’s price remains at roughly the same level as pre-halving, then a drop in hash rate is expected (and the network becomes less secure). This is because less efficient miners, now earning lower mining reward income, will be forced to shut down or point their computers to mine another cryptocurrency where they are still cost competitive.

Placing the 2020 halving impact on network security in context

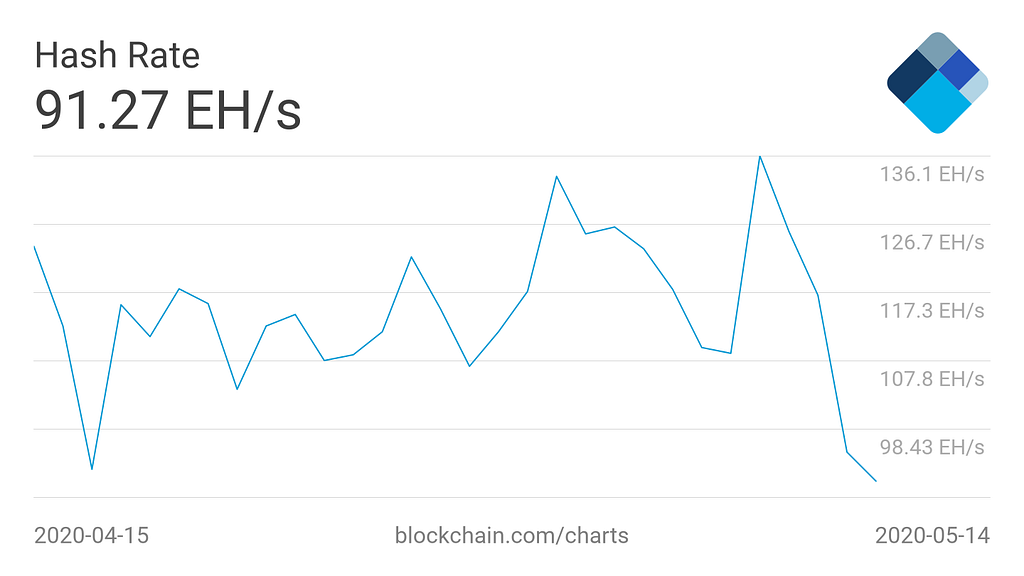

Following Monday’s halving bitcoin’s hash rate appears to have dropped by approximately 30%, from a pre-halving estimated 136 exahashes to 91 exahashes on Friday (Figure 2).⁴

Figure 2: Bitcoin’s estimated hash rate dropped 30% post-halving

How should we interpret this apparent drop in hash rate?⁵

Before answering this question it is helpful to first understand that the market value of a cryptoasset or smart contract can be viewed as something akin to a hacker “bounty”. The more valuable the asset or contract (“the bounty”), the more profitable it may be to attack/hack, and the more likely it is to be targeted.⁶

While the following is an admittedly imperfect and incomplete security heuristic, the level of comfort around blockchain network and smart contract security can be viewed from the perspective of how much value is at risk, and for how long value has remained secure. In other words, how big and “battle tested” a network is matters.

This security heuristic works as follows:

additional comfort can be gained around systems that hold secure a relatively larger amount of value over longer time periods.

By this measure, the bitcoin network offers the greatest comfort level around network security of any cryptoasset system by a considerable margin.

Hash rate alone is an incomplete measure of network security⁷

By checking previous hash rate levels at different points in time when bitcoin’s market value was roughly comparable or higher than current levels can provide some helpful context around network security.

More precisely, if a lower level of hash rate (network security) was able to successfully secure the network at a market value similar to today’s level, then this may suggest a sufficient level of security exists today to protect the current market value from attack.

This framework for comparing relative security over different points in time can be expressed with the following simple formula:⁸

Market Value (Hash Rate x Cost per Hash) =Market Value Adjusted Network Security (MVANS)

where the time period with the lower MVANS ratio may offer more relative security when comparing security across two different time periods with comparable market values.

How bitcoin’s current network security compares with comparable historical periods

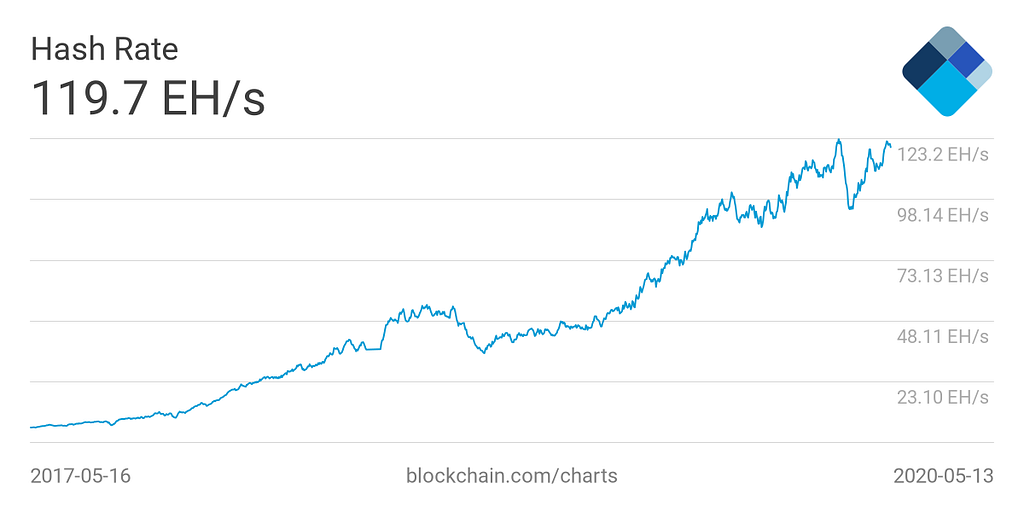

Zooming out over the last year we can see the current hashrate is over double the level in May 2019, when bitcoin’s price traded at around $8,000-$9,000.⁹ This means that today, substantially more hash rate is securing a somewhat larger but roughly similar level of market value than this time last year.

Today’s network appears significantly more secure than a year ago

Looking back to 2017, bitcoin’s current hash rate is over 9x greater than it was in December 2017, when bitcoin’s price was nearly double its current level at approximately $19,000 (Figure 3). Again, the network today would appear to be operating with a much higher level of security relative to market value than it did during the days surrounding bitcoin’s all time price high in late-2017.

Figure 3: Bitcoin’s estimated hash rate is still more than double the level in May 2019 and over 20x greater than May 2017

Overall, despite the post-halving estimated hash rate drop, the bitcoin network appears substantially more resilient to 51% attacks compared to prior periods when roughly comparable or greater levels of market value were secured with significantly lower total computing power.¹⁰

Part 1 wrap-up

Bitcoin continues to “just work”. And every day it keeps working further cements confidence in bitcoin’s ability to secure value.

But as we peer out over the next decade, can we continue to expect bitcoin to just keep working? What will happen to bitcoin’s security once the mining reward of new coins becomes de minimis, or when the reward is completely exhausted per the software protocol rules around the year 2140? We’ll examine these questions in a forthcoming Part 2.

For more insights from our research team, go to our Research page and follow our Head of Research, Garrick Hileman on Twitter.

Footnotes

[1] Based on our Twitter poll it appears there is a preference for using the term “halving” rather than “halvening”.

[2] When bitcoin was first launched into existence by Satoshi Nakamoto miners could earn a reward of 50 bitcoins for securing the network and solving a “crypto puzzle” randomly generated by the bitcoin software protocol. This reward is issued on average every 10 minutes, and miners’ efforts to solve this puzzle play a crucial role in bitcoin’s security.

As codified in the bitcoin protocol, in 2012 the mining reward was cut in half for the first time to 25 coins. And then in 2016 the reward was once again cut in half to 12.5 coins. Each of these reward cuts makes the supply of new, freshly minted bitcoins relatively scarcer.

Halvings will continue until the year approximately 2140 when the total supply of bitcoins reaches its capped limit of 21 million coins.

[3] However, looking at hash rate alone is an incomplete measure of bitcoin’s network security. More efficient computers (ASICs) can produce more hashes (security) at a lower cost. Other factors, such as the potential gains from attacking the network, must also be considered when evaluating network security.

[4] Because hash rate is estimated, and not a knowable metric, we would generally prefer to look at average hash rate over a period of time rather than single points of time as we have done here. In other words, initial single point in time estimates can sometimes prove misleading.

[5] Until the next difficulty retarget estimated to be on the Tuesday 19th May, this drop in hash rate results in fewer blocks being mined, meaning that fewer transactions can be confirmed and the network fees has increased due to the mempool being congested. After this difficulty retarget, the number of blocks being mined will move closer to approximately 1 block every 10 minutes.

[6] This is similar to the following hypothetical scenario involving a bank robber choosing between two different banks to rob: if the robber faces the same security and punishment risk at both banks then the robber is more likely to target the bank holding the most cash.

[7] The distribution (decentralization) of hash rate across miners is also critical to ensuring security against various network attacks.

[8] Unfortunately cost per hash is unknown as miner electricity costs (and other miner operating costs) are not publicly available. While the dominance of the Antminer S9 for much of the period examined in this blog may help mitigate the inability to incorporate the variance in mining hardware efficiency over the examined period, the lack of cost data limits the precision around comparing bitcoin network security across different periods using MVANS.

[9] A year ago there were fewer bitcoins in supply, meaning total market value that incorporates coin supply is a more precise method for comparing across periods.

[10] While the results of this comparison might provide some reassurances, we must emphasize that the above analysis relies on estimated metrics and looks at a single aspect of network security (hash rate). There are also other ways to attack the bitcoin network beyond a 51% hash rate attack.

Battle Testing Bitcoin: The 2020 Halving Post Mortem (Part 1) was originally published in @blockchain on Medium, where people are continuing the conversation by highlighting and responding to this story.