Around the Block #8: The promise and potential of synthetic assets

Coinbase Around the Block sheds light on key issues in the crypto space. In this edition, Justin Mart explores the synthetic asset landscape as well as other notable news in the space.

Today, most Decentralized Finance (DeFi) applications look like copies of traditional financial products. You can swap one token for another, borrow or lend a token in a money market, and even trade on an exchange with margin and leverage.

But DeFi can go much further. Blockchains are open, global platforms that carry programmable value at their core. It’s only a matter of time before DeFi produces something truly unique — with no corollary in the traditional world.

Enter the first possible example: synthetic assets

What are Synthetic Assets?

Synthetic assets are a new type of derivative. Recall that derivatives are assets whose value is derived from a different asset or benchmark. Things like futures and options, where buyers and sellers trade contracts that track the future price of an asset.

DeFi simply adds a twist: synthetic assets are tokens that are digital representations of derivatives. Where derivatives are financial contracts that provide custom exposure to an underlying asset or financial position, synthetic assets are simply tokenized representations of similar positions.

As such, synthetic assets carry unique advantages:

- Permissionless creation: Blockchains like Ethereum empower anyone to construct synthetic asset systems

- Easy access and transferability: Synthetic assets are freely transferable and tradeable

- Global pools of liquidity: Blockchains are global by default, anyone in the world can participate

- No central party risk: There are no central parties with privileged control

What are some examples?

To start, synthetic assets can tokenize physical assets, bringing them onto a blockchain and imbuing them with all the advantages listed above. Imagine anyone in the world buying a token that tracks the S&P 500, and being able to use that token as collateral in other DeFi projects like Compound, Aave, or MakerDAO. The model can be extended to commodities like gold or grains, equities like TSLA or indexes like SPY, debt instruments like bonds, and anything else.

Consider that last piece — this is where it gets exciting. We’re not far away from exotic, novel instruments like pop culture markets, meme markets, personal token markets, etc, that can be traded through synthetic assets.

And the implied market size is substantial given that any asset can have a synthetic version brought onto a blockchain. Just as one reference point, the total global equities trading volume Q1’20 is ~$32.5T, which theoretically could be replaced in part by synthetic versions that trade on a global pool of liquidity with open and free access to anyone.

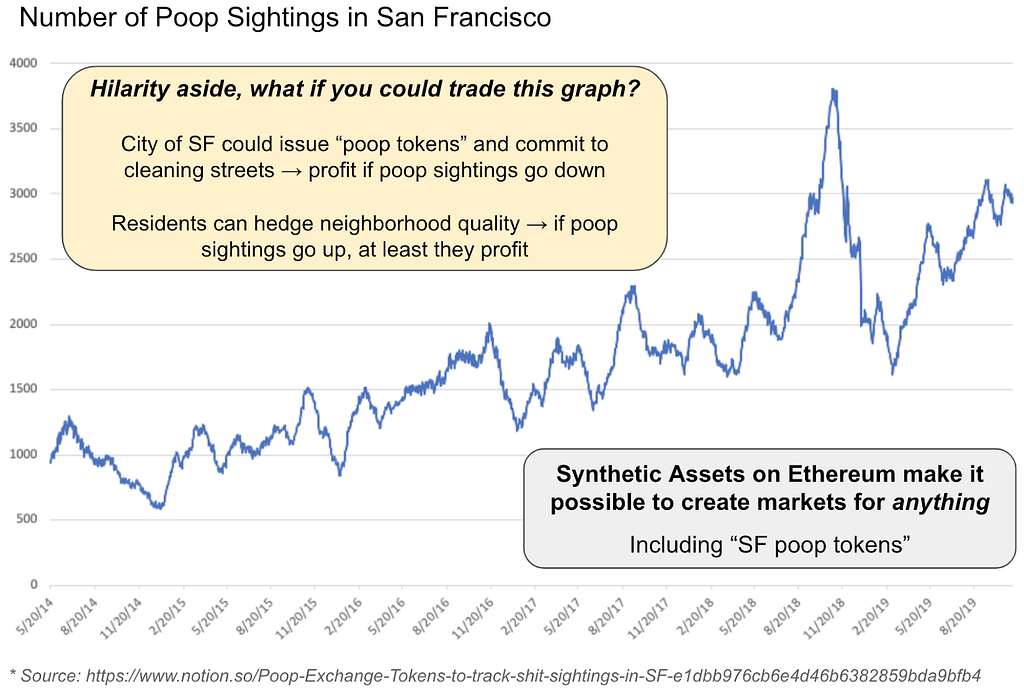

A specific example: Poop Exchange

In late 2019, a few developers had an idea and released a prototype — what if we had a synthetic asset that tracks the frequency of poop sightings in San Francisco? Token holders profit when more poop is sighted, and the token issuer profits if poop sightings decrease, using an oracle that simply reports the number of poop sightings.

This poop token market could align incentives for local SF government. If the city of SF issues poop tokens, they are incentivized to clean up the streets in order to profit. Conversely, citizens could purchase poop tokens as an emotional hedge, ensuring that at least they make money if the streets don’t get better. A simple example, but showcases the potential of synthetic assets and markets for anything.

What types of Synthetic Asset platforms exist today?

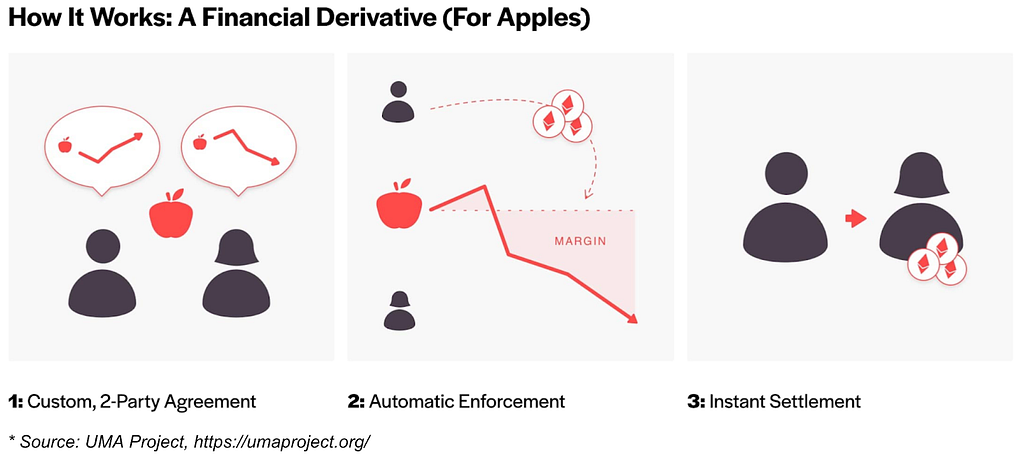

Universal Market Access (UMA)*

UMA is a synthetic-asset protocol that allows anyone to recreate traditional financial products, exotic crypto-based products, and more. Through UMA, two counterparties come together to permissionlessly create an arbitrary financial contract that is secured through economic incentives (collateral), and enforced through smart contracts on Ethereum. Given Ethereum’s global, open nature, the barriers to entry are significantly reduced, creating “Universal Market Access.”

Today, UMA community members are focused on first building tokenized yield curves (e.g., yUSD), but the platform can be used by anyone to create any manner of financial contracts. Just some examples:

- Crypto-based contracts: Crypto futures tokens, yield curves, perpetual swaps, etc.

- Tokens that track cryptocurrency or DeFi metrics: E.g., BTC dominance, DeFi TVL charts, decentralized exchange (DEX) market share charts, or any other metric.

- Traditional financial products: US & Global equities (e.g., a TSLA or APPL token), private pension plans, insurance and annuity products

- Exotics: The poop.exchange example, pop culture, meme markets, etc.

UMA is positioning itself as the protocol for the long-tail of exciting and creative financial markets. As with poop.exchange, some of these contracts might be used to fundamentally realign incentives — a zero-to-one innovation!

* Note: UMA is a Coinbase Ventures portfolio company

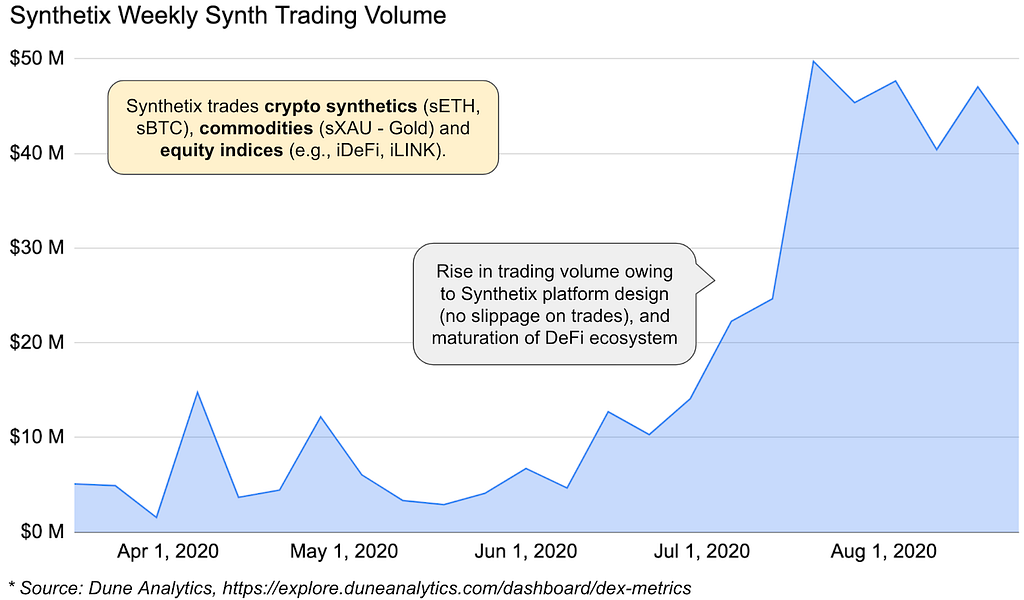

Synthetix

Synthetix is a protocol for creating global liquidity for synthetic assets on Ethereum. Synthetix facilitates the creation and trading of numerous asset classes including crypto, equities, and commodities, all on-chain.

Tokens that track the price of these assets can be bought and sold natively within the Synthetix ecosystem, which uses a combination of collateral, staking, and trading fees to operate. Notably, the Synthetix ecosystem is transitioning to be operated entirely by a structure of DAOs, where the SNX token is central to the entire ecosystem. SNX can be staked to provide collateral backing synthetic asset positions while accruing trading fees in return, and act as a governance token in the DAOs.

As the leading synthetic asset platform in DeFi, Synthetix has currently issued over $150 million of “Synths”. Chief among them is sUSD, their platform’s stablecoin, which is approaching $100M in market cap.

Today, Synthetix mostly offers crypto-based synthetic assets like sETH and sBTC, as well as index-tokens like sDeFi and sCEX that track a basket of assets. Much of their traction can be owed to their unique market design, where assets trade against an oracle price and therefore suffer no slippage when buying or selling.

Others

Several other synthetic asset platforms are being built with unique tradeoffs and design decisions. Non-exhaustively, consider Morpher, DerivaDEX*, FutureSwap, DyDx, and Opyn, Hegic, or Augur.

* Note: DerivaDEX is a Coinbase Ventures portfolio company

Conclusion

Synthetic assets are new primitives made possible by the maturation of Ethereum and the DeFi ecosystem. But we are just at the beginning, and should not be blind to the inherent risks:

- Smart contract risk: Exploits in smart contracts are possible, and synthetic assets could be strong targets

- Governance risk: These platforms are mostly often governed by their decentralized participants, which remains relatively untested at scale

- Oracle Risk: Many synthetic assets rely on oracles to function properly, which carry their own trust assumptions and failure modes

- Platform risk: Ethereum and other underlying blockchains may struggle at scale, and perform worse the moment you need them most. Fee markets can be inefficient, and frontrunning or griefing attacks could be challenging.

However, balance the downside with the potential. Synthetic assets represent open and global access to existing financial markets, itself an important primitive. But cut deeper and you can see the innovation behind markets for anything.

We can potentially use these primitives to construct novel, new financial markets that can fundamentally align incentives and change the way we live our lives.

To participate in the emerging cryptoeconomy, sign up for Coinbase today.

Quick Hits: Commentary on Notable News

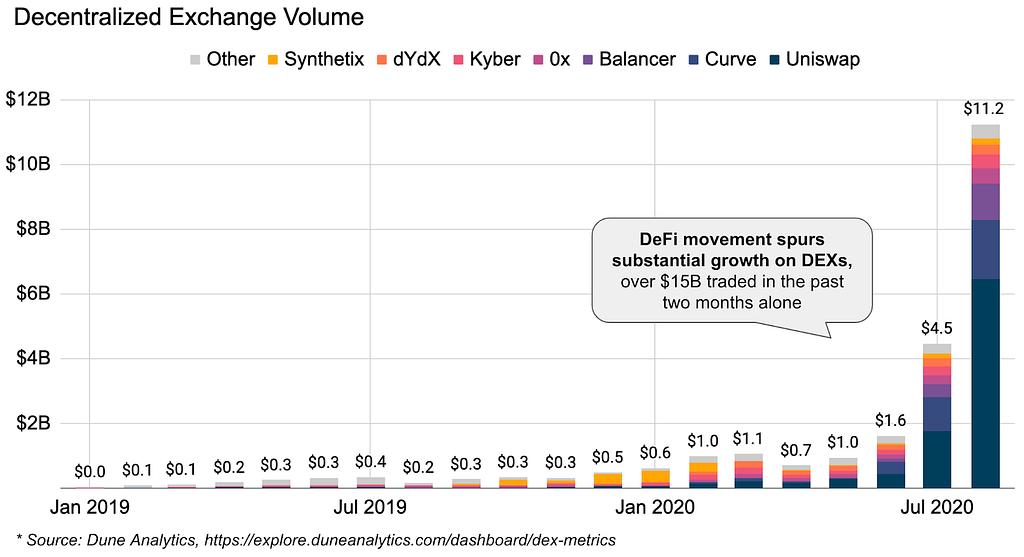

DEX Volume Continues Strong Growth, Helped by Novel DeFi Monetary Experiments

DEXs have historically struggled with traction, doing just ~$3B collectively in 2019. However volume has exploded in 2020, with >$20B YTD and $15B in just the past two months. This growth trajectory accelerates the DEX adoption curve and ushers them into the spotlight.

This volume comes from ~200K active addresses over the last month (where Uniswap alone records ~160K, but likely some crossover between platforms). Uniswap is dominating DEX market share with ~45% YTD (and 70% in the last week). Other popular DEXs are Curve and Balancer with ~16% and ~7% YTD market share, but on the horizon are new entrants Serum, Sushiswap, and more.

Key to DEX growth is the emergence of several DeFi projects pioneering novel monetary models, and typically launched through “fair launches” — where there are no previous owners and no outside funding, a fixed supply, and distribution solely through yield farming. As such, they represent a layer of experimentation and game theory never seen before. Some examples:

Ampleforth (AMPL)

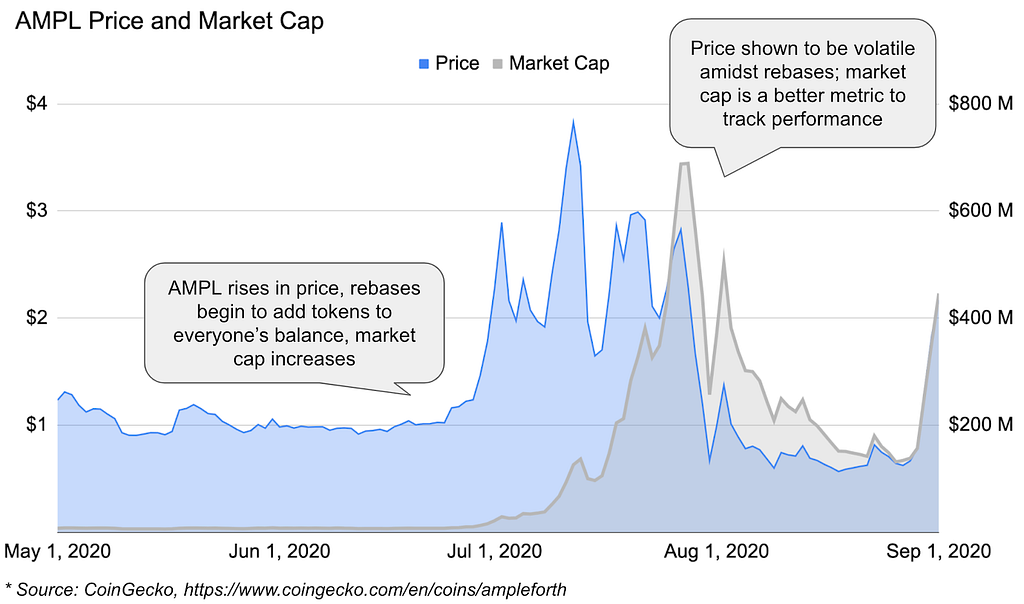

The pioneering example is Ampleforth (AMPL), which has an economic model that aims to keep the AMLP token near $1 by automatically adjusting supply in response to demand, a process known as rebasing. Quite simply: when AMPL is above $1, everyone’s balance increases in order to drive the unit price down. Conversely, when AMPL is below $1, everyone’s balance decreases in order to drive the price up. Note that despite rebases, your market share will stay constant.

As we can see, the AMPL price is anything but stable. The monetary experiment instead seems to produce a rapidly oscillating price and market cap with whipsaw volatility, surpassing $600M in market capitalization at one point.

Yams (YAM)

Yam was a surprise launch on August 11, supposedly built in 10 days by borrowing code from several battle tested DeFi projects. It functions nearly identical to AMPL, but with some differences:

- A rebase mechanism nearly identical to AMPL, targeting $1

- A treasury controlled by YAM holders, funded by allocating a portion of rebases to purchase stablecoins

- Governance contracts that enable community ownership of the treasury, where votes determine how the treasury is used

- Fair distribution with no team or investor token allocations. Tokens are entirely distributed via yield farming

What followed was a modern-day DeFi story; the inaugural version of YAMs unfortunately shipped with a bug in the rebase contract and the governance contract. The surprising juxtaposition meant that attempts to fix the rebase contract were hindered by the bug in the governance contract, and ultimately resulted in a broken system with $750K of stablecoins permanently stuck.

The fallout? YAM V1 is broken, but the community rallied, forked the code, and is in the process of launching YAM V2.

Following AMPL and YAMs, other tokens quickly arrived with their own unique flavors:

- Spaghetti.Money: A yield farmed token, but with no governance (to avoid the fate of YAM), and deflationary (1% of every transaction is burned)

- Shrimp.Finance: A yield farmed token with no rebase. Shrimp chose DICE and CREAM as two less mainstream tokens to use as staking, demonstrating a novel mechanism to reach different communities

- Zombie.Finance: A yield farmed, rebasing token with an added rule eliminating tokens holders with less than 1 ZOMBIE after a rebase

- $BASED: an economic game of chicken which started with yield farming and will soon transition to rebasing

And who knows what tomorrow will bring. These experiments are being played out in real time, with real value, and for now are traded predominantly on decentralized exchanges.

News from Coinbase

- Borrow cash using Bitcoin on Coinbase

- Marc Andreessen and Gokul Rajaram join the Coinbase board of directors

- Numeraire, UMA, BAND, and Celo launch on Coinbase Pro

- Marcus Hughes joins Coinbase as GM for Europe

- Coinbase publishes ERC-20 token listing guidelines

- Manish Gupta joins Coinbase as VP of Engineering

News from the Crypto Industry

- FTX acquires Blockfolio for rumored $150M in bid for retail expansion; and hires Robinhood’s former head of crypto

- Aave’s U.K. entity granted E-Money Institution License, eyes fiat rails

- Blockchain.com raises interest rates on interest-bearing accounts

- Binance announces DeFi savings product, touts 14.8% APY

Institutional Crypto News

- BitMEX set to require KYC for all accounts

- SEC updates the accredited investor definition; Hester Pierce sworn in for second term

- Fidelity launches inaugural fund for wealthy investors

- Former Prudential CEO George Ball advises wealthy investors to buy Bitcoin

News from Emerging Crypto Businesses

- Uniswap fork Sushiswap reaches $700M TVL less than one week after launch

- FTX partners with Solana to launch Serum, a new DEX

- Wrapped BTC continues to grow with minting rate surpassing mining rate

- ETC hit with 3rd 51% attack this month

- ETH 2.0 testnet Medalla encounters headwinds

The opinions expressed on this website are those of the authors who may be associated persons of Coinbase, Inc., or its affiliates (“Coinbase”) and who do not represent the views, opinions and positions of Coinbase. Information is provided for general educational purposes only and is not intended to constitute investment or other advice on financial products. Coinbase makes no representations as to the accuracy, completeness, timeliness, suitability, or validity of any information on this website and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. Unless otherwise noted, all images provided herein are the property of Coinbase.

This website contains links to third-party websites or other content for information purposes only (“Third-Party Sites”). The Third-Party Sites are not under the control of Coinbase, and Coinbase is not responsible for the content of any Third-Party Site, including without limitation any link contained in a Third-Party Site, or any changes or updates to a Third-Party Site. Coinbase is not responsible for webcasting or any other form of transmission received from any Third-Party Site. Coinbase is providing these links to you only as a convenience, and the inclusion of any link does not imply endorsement, approval or recommendation by Coinbase of the site or any association with its operators.

Around the Block #8: The promise and potential of synthetic assets was originally published in The Coinbase Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.