Around the Block #6: Bitcoin’s dominance alongside Coinbase customer behavior, the coming DEX…

Around the Block #6: Bitcoin’s dominance alongside Coinbase customer behavior, the coming DEX revolution, and other recent crypto news

Coinbase Around the Block, sheds light on key issues in the crypto space. In this edition, Justin Mart analyzes Bitcoin’s continued dominance alongside Coinbase customer behavior, the coming DEX Revolution, as well as other notable news in the space.

Bitcoin’s dominance and Coinbase customer behavior

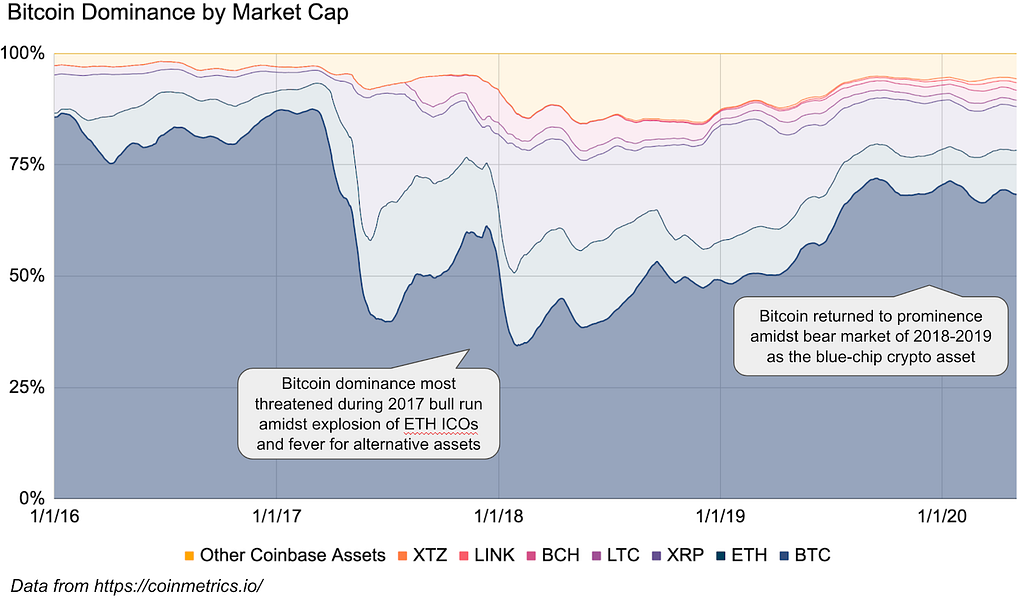

Bitcoin’s market cap dominance relative to other cryptocurrencies is well known. The most commonly cited metric is relative market capitalization, comparing Bitcoin’s network value to other cryptos.

But how does Bitcoin’s dominance extend beyond market cap? Specifically, how does Coinbase customer behavior also demonstrate Bitcoin’s dominance? First, let’s take a look at Bitcoin’s market cap dominance over the years:

In general, Bitcoin’s position as the blue-chip asset has remained unchallenged. That said, we do see a trend where bull markets show increasing traction among alternative assets.

This could be for a variety of reasons, but one is largely psychological. As people feel good about their initial crypto investments (into Bitcoin), they branch out to find other possible categorical winners (as evident in the 2017 bull run). The converse is also possible, as prices drop and fear grips the market (2018–2019), a flight to crypto safety drove Bitcoin back to the forefront.

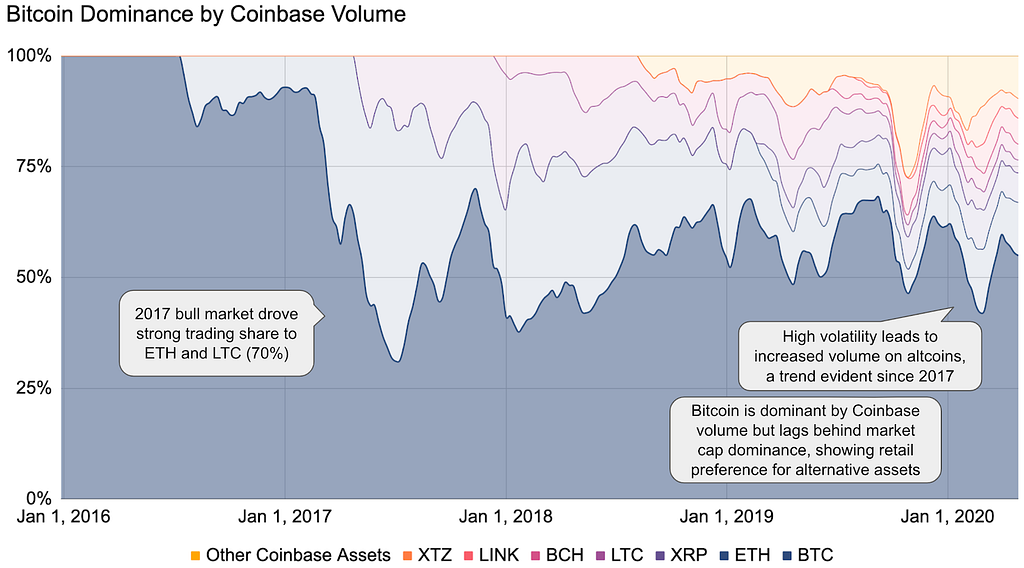

However we are only looking at market cap dominance, how the market in aggregate values these assets. An alternative metric would be how Coinbase customers trade these assets:

As we can see, the same large-scale trend is evident. Bitcoin is dominant, but was threatened in 2017, and regained dominance in 2018–2019. However, retail volume on Coinbase shows an increased proclivity to purchase and trade alternative assets.

This increasing drive is in part due to Coinbase’s continued addition of new assets, but a deeper cut shows that price volatility significantly swings consumer behavior toward non-BTC assets. This trend first appeared in 2017, and is now evident in large spikes. Notably in late 2019 (with Tezos, Chainlink, BAT, 0x, and Stellar) and again in early 2020 (driven by Ethereum, Tezos, and Chainlink).

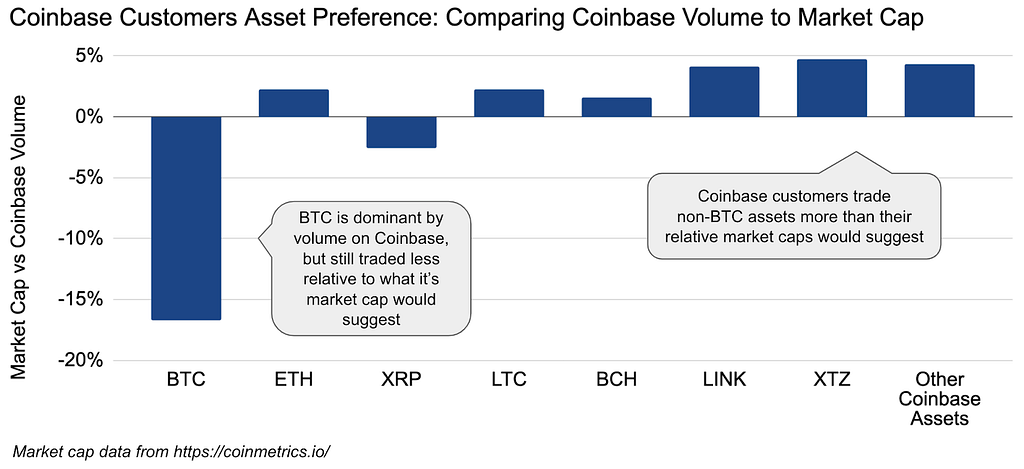

On average, Coinbase customers trade non-BTC assets at a ~3% higher rate than their relative market caps would suggest.

So on one hand, Bitcoin is clearly dominant, but on the other hand Coinbase customers show a relative preference to also move into other assets.

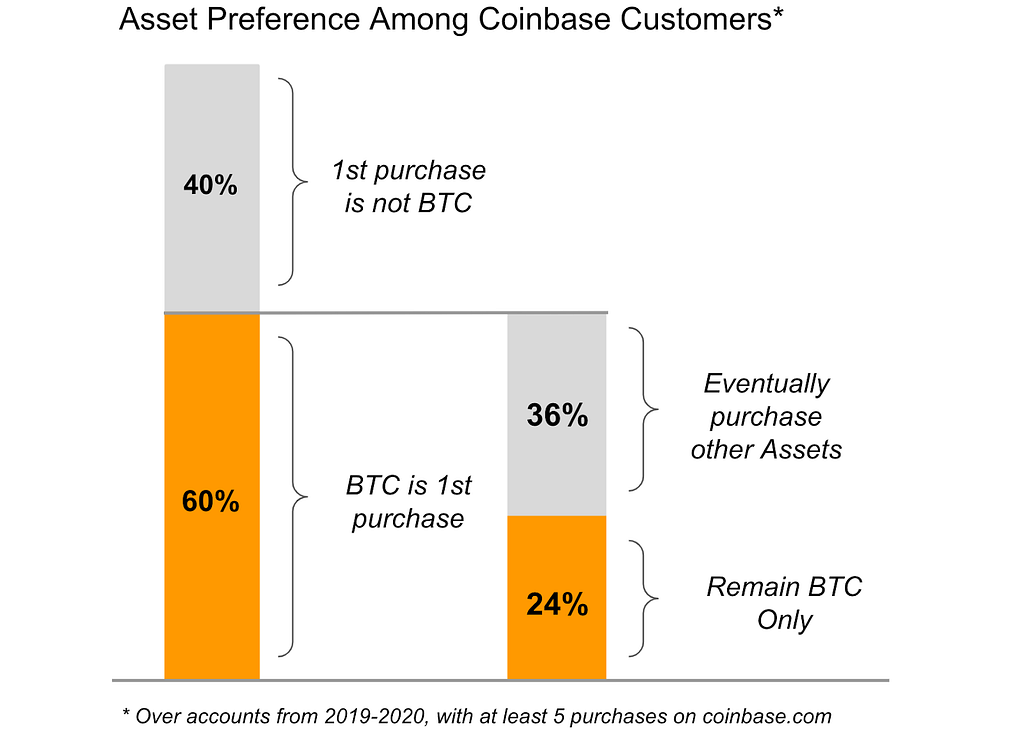

The data bears this out. Among customers with at least 5 purchases, 60% start with Bitcoin but just 24% stick exclusively to Bitcoin. In total, over 75% eventually buy other assets.

Why is Bitcoin so dominant in the first place?

It’s the king for good reason:

- Ethos and mission: Bitcoin is disrupting money, and is the world’s first currency with a truly fixed supply

- Mindshare: Bitcoin is the pioneer and carries the most traction

- Security: It’s the most secure PoW asset, and it’s not even close

- Decentralization: Difficult to quantify, but Bitcoin is decentralized with the most nodes, largest distributed hashrate, and arguably the most conservative governance function

- Infrastructure and liquidity: Bitcoin has the most mature services and the deepest pools of liquidity

- Technical simplicity: Where other protocols seek to expand to novel use-cases, Bitcoin’s technology is already capable of achieving its mission

- Creation myth and intangibles: Bitcoin just has the it factor. An anonymous creation myth, an explosive vision, undeniable traction, wrapped in a new economic model that is governed by math

Bitcoin is carrying the flag for the entire cryptocurrency space, and we should embrace it. But the retail preference to branch into other assets shows that new users come to crypto through Bitcoin, but generally begin to look for alternative assets and use-cases. In this sense, Bitcoin is also top of the funnel for broader crypto growth.

To the extent we believe that alternative assets and networks will provide differentiated services (beyond store of value and digital gold as Bitcoin is targeting), it will be important for the industry to build support for these other assets as well.

Bitcoin is king, and likely to remain king for a long time. But it is also paving the way for a thousand flowers to bloom.

The coming DEX revolution

Since the launch of Ethereum we have all speculated on the potential disruption of centralized exchanges with the emergence of decentralized exchanges (DEXs). This is the first of a two-part series examining the DEX space and the potential coming revolution.

Context

Crypto’s killer-app today is investment and speculation, gaining exposure to a technology that could be incredibly transformative in the future.

Most trading is performed on a centralized exchange where one platform holds customer funds, matches buyers to sellers, and offers crypto and fiat services to manage deposits and withdrawals. But centralized exchanges have their challenges. They reside in specific geographic locations and subject to stringent regulations, require customers to open accounts and deposit their funds, place limits and restrictions on their customer’s actions, and have been the target of malicious attackers. In general, they are centralized choke-points that stand in contrast to the open, decentralized ethos of cryptocurrency.

Decentralized exchanges shine where centralized exchanges struggle:

- Safe: Funds are never transferred to any third party or generally subject to counter-party risk, you trade directly from your own wallet

- Global and permissionless: There is no concept of borders, let alone restrictions on who can trade

- Ease of use and pseudonymous: No account signup or personal details are required

- Better execution (potentially): Theoretically, we should see global DEX liquidity accrue to a handful of winning platforms, enabling deep liquidity

Given their clear advantages, why haven’t DEXs already disrupted centralized exchanges?

Turns out, they also struggle with some significant challenges:

- User experience: Trading on a DEX is performed through self-custodial wallets, which are confusing and intimidating for many

- Speed and scale: All trades are settled on-chain, bottlenecked by block times and base transaction throughput. (Try sending 1000s of tx/sec on Ethereum today…)

- Limited trading pairs: DEXs are confined to only trade tokens on single blockchain, there is limited interoperability. For example, it’s very difficult to trade BTC-ETH pairs on a DEX, because bitcoins reside on the Bitcoin blockchain, not on Ethereum (this is changing soon).

- Limited feature parity: Centralized exchanges can quickly build new services, whereas DEXs must work within the limitations of each blockchain, and carefully ship new features that have been audited for security

- Regulation: While DEXs are intended to be decentralized and resistant to regulatory pressure, some hybrid models have run into problems. Increased pressure from regulators could stifle development and traction.

But what gets us excited? All of the above issues are tractable. They boil down to product and technology challenges that have conceptually clear paths forward. Eventually, we should be able to create a DEX that rivals the trading experience of centralized exchanges, while retaining all their native benefits. When this day comes, centralized exchanges could be ripe for significant disruption.

Current landscape

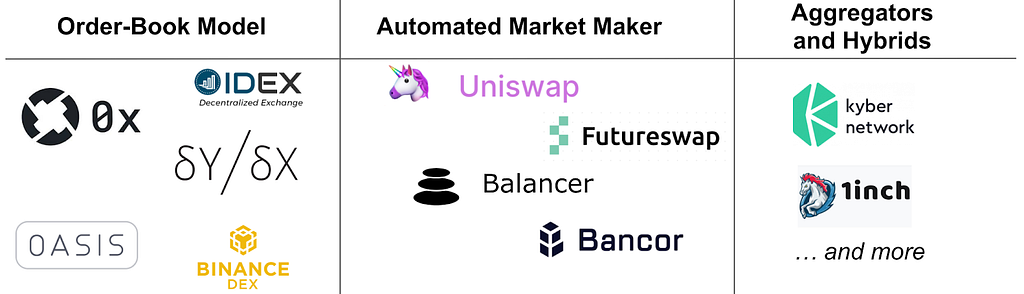

DEXs today are generally differentiated by two main segments:

(1) How are trades settled?

DEXs generally either adopt a traditional Order Book model or an Automated Market Maker (AMM) model.

Order books match each buyer to a unique seller (identical to trading on centralized exchanges like Coinbase Pro). This model has clear advantages, where price discovery is transparent and efficient for highly liquid books, but can also be subject to some manipulation (spoofing, frontrunning, etc), usually in more illiquid books.

AMM models match each trade against a pool of capital in a smart contract, where the price of the trade is determined by the ratio of assets in the pool. It might sound confusing, but this model does not require a specific counter-party to each trade (trades are performed against a smart contract). This makes AMM models ideal for more illiquid tokens. As a downside, traders generally suffer higher slippage when trading large amounts.

(2) Where are trades settled?

DEXs either settle trades on the base blockchain (usually Ethereum), or look to gain more throughput by routing trades through a sidechain before final settlement is pushed back to the main chain.

While sidechain-based execution shows promise, there are still security, UX, and decentralization tradeoffs with current models, leading to limited traction today. But these are also tractable challenges, and promising models are scheduled to launch over the next couple years. There are also some hybrid models that fuse on-chain and off-chain models, and an emerging number of DEX aggregators that provide best execution.

Today’s popular DEXs almost exclusively settle trades directly on Ethereum, owing to its significant lead in developer traction, large token network, and broad infrastructure and wallet support.

Volume and traction

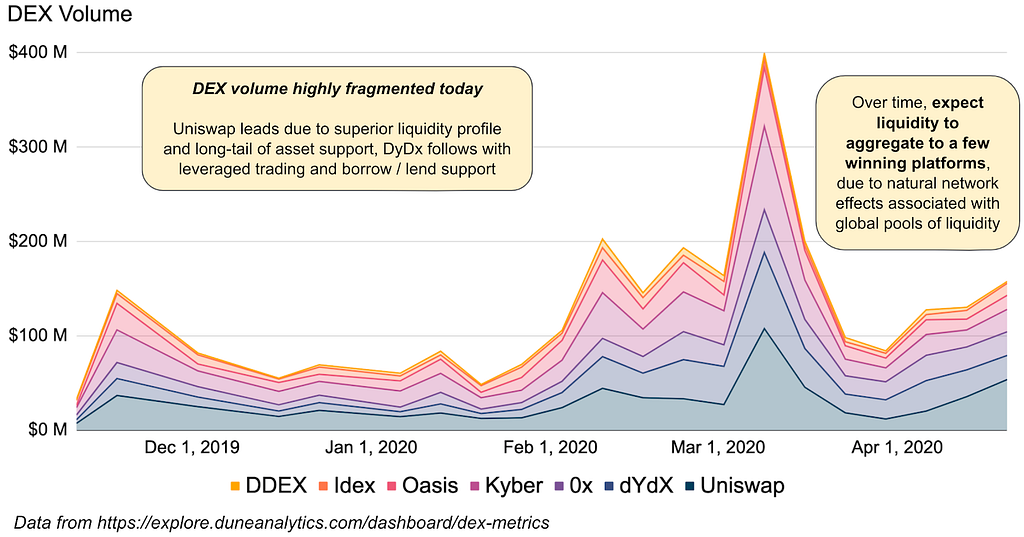

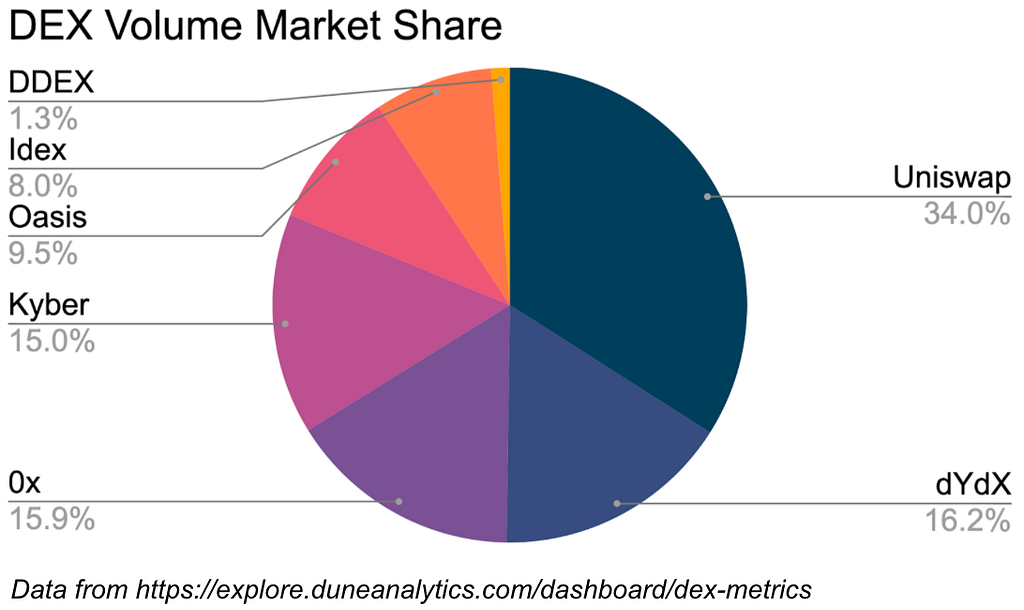

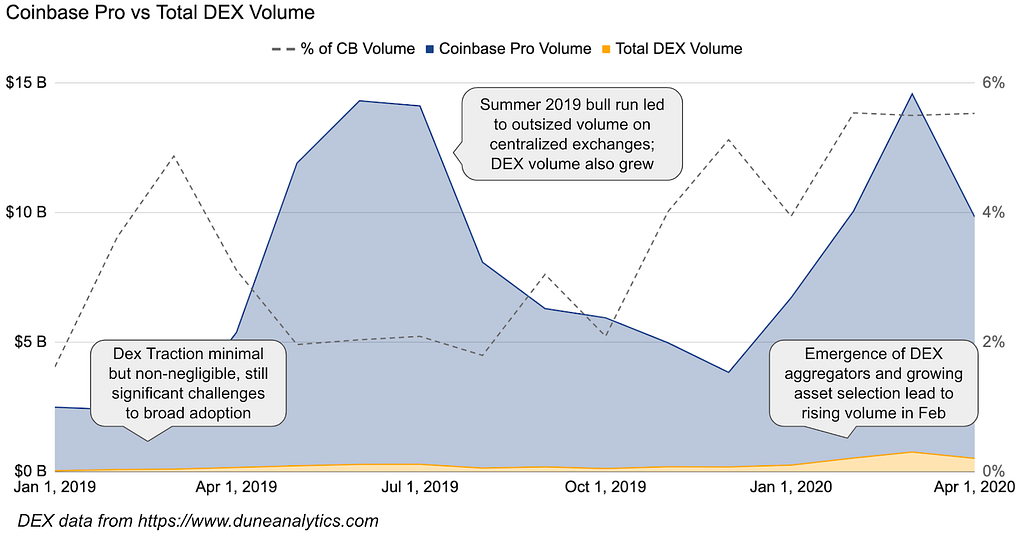

Due to DEX’s challenges around scale & throughput, user experience, and limited trading pairs, traction has been minimal compared to centralized exchanges. But DEX volume has been slowly growing in market share.

According to Dune Analytics, Uniswap leads in volume and traction today with its AMM model that provides liquidity advantages. DyDx is second with leveraged trading, borrow/lend capabilities, and a recently launched BTC perpetual contracts market similar to BitMEX.

DEX volume is still small in aggregate compared to centralized exchanges, but shows steady growth. Today, total DEX volume accounts for ~6% of Coinbase Pro volume.

Looking into the future

DEX volume is small today, but is primed for substantial growth as the ecosystem matures. The timing is up for debate but their challenges are solvable; it’s more a matter of when and not if.

Key areas to watch:

- Improvements to self-custody: Making it dead-simple to manage crypto in your own wallet will increase the pool of users ready to trade on DEXs

- Interoperability: The ability to bring assets on other blockchains together will enable a larger selection of trading pairs

- Sidechain and L1 scaling advances: Improving the trading experience and mitigating frontrunning and griefing attacks will bring near UX-parity

- Regulatory pressure: This is a double-edged sword — If regulators begin pressuring centralized exchanges, DEXs could emerge as the only viable option for some consumers. Conversely, if regulators pressure DEX developers and teams, these platforms may take longer to emerge at scale.

- Emerging feature differentiation: DEXs are tied to programmable money, and they may create novel new derivatives and synthetic assets, combined with deep composability with other DeFi services, to create a truly differentiated product offering

How close are we to this reality? It’s difficult to say with certainty, but considering the long development timelines associated with shipping code to blockchains, and the slow-but-steady growth in those key areas to watch, it’s not unreasonable to think the DEX revolution is still a few years away.

Quick Hits: Commentary on notable news

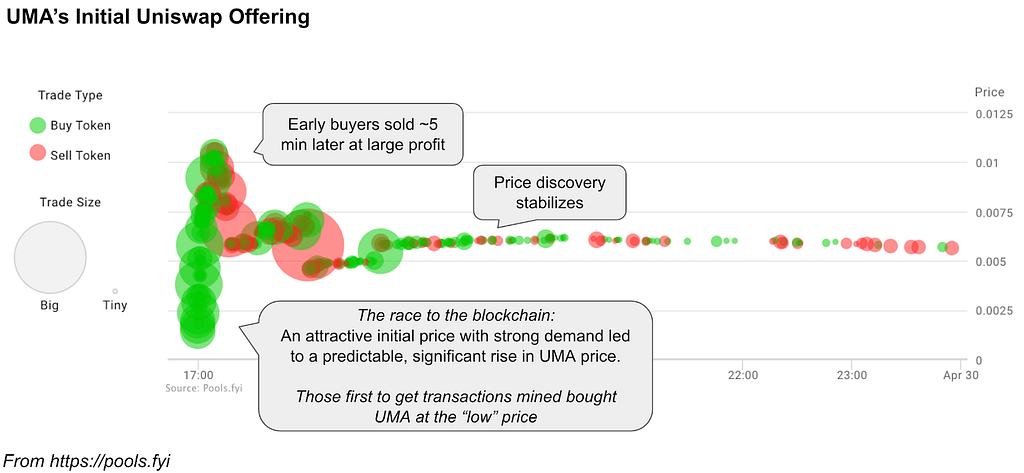

UMA performs Initial Uniswap Offering

In a first for DeFi, UMA just performed an Initial Uniswap Offering (IUO). This process is essentially an ICO + Exchange Listing all in one, providing some notable advantages:

- Uniswap is simple: ICOs required bespoke and audited smart contracts, and sold tokens directly to the public. With Uniswap, you forgo all the complexity and simply create a market and add liquidity. A 2-step process that takes ~5 min, no dev experience or audits required.

- Liquidity and price discovery are built-in: ICOs offered a set amount of tokens at a set price, and only later found true price discovery when centralized exchanges listed their tokens. Uniswap provides instant price discovery and continuous liquidity with no need for market makers via their AMM model.

- Issuers can profit from secondary trading: Providing liquidity to Uniswap brings trading-fee revenue (minus impermanent loss)

As a downside, there is no two-sided market initially (only buyers, no sellers), which is likely to result in a large pop in the price before sufficient price discovery takes place. And without any external source of tokens, it also means the price can never fall below the starting price. For UMA, these mechanics induced a race to the blockchain to see who can be first to get a transaction mined and trade at favorable initial prices.

Despite early learnings, UMA’s process was a success. The model has been shown to work, and its simplicity combined with easy liquidity could be compelling for many projects

Personal token sales take off

Just this year:

- Former Coinbase Lawyer Reuben Bramanathan tokenized his time and sold his tokens to the public via Uniswap

- NBA star Spencer Dinwiddie tokenized his current NBA contract

- Saint Fame tokenized commercial goods and developed a community

- Alex Masmej and Kerman Kohli tokenized their future earning potential (!)

DeFi continues to push the boundaries of capital formation. These are the first glimmers of what could be new and pervasive funding mechanisms. Imagine high school athletes tokenizing future contracts as insurance against injuries, or up and coming artists tokenizing their future record sales.

But the details matter. In this case, if tokenization events constitute an investment contract, they could be deemed securities by the SEC. The tension between regulation and DeFi products is palpable, and could hold back adoption until we get further clarity from regulators.

New DEX derivatives platforms make a splash

Futureswap is a DEX with a novel combination of Compound, Uniswap, and BitMEX. They currently only offer a ETH-DAI book, but provide 20x leveraged trading that starts at an oracle’s price (no order book), with a modified Uniswap-style price curve (limiting slippage), kept in check by a dynamic funding rate (ala BitMEX).

It’s a novel idea, ideal for speculators because no underlying assets are swapped. During a 4-day alpha launch they posted $17M in trade volume and gained $1.5M in their liquidity pool, a rate that would place them at #2 in DEX volume only behind Uniswap!

Separately, DyDx launched Perpetual Bitcoin Contracts similar to BitMEX and with 10x leverage. In contrast to Futureswap, DyDx operates a true order book and provides a public-liquidation mechanism on underwater trades. This also marks the first time a Bitcoin-based trading book has been offered at scale through a DEX.

Taken together, these are nascent but strong data points that suggest DEX Derivatives markets could have strong product market fit.

Links

Coinbase news

- Coinbase makes investing easy with dollar cost averaging

- Coinbase welcomes Brett Tejpaul as Head of Institutional Coverage

- Support for Compound Governance added to Coinbase Custody

- Introducing the Coinbase Price Oracle

- Coinbase: Bitcoin’s Third Halving Occurred This Week

News from the crypto industry

- Robinhood raises $280M series F at $8.3B valuation to scale platform and push for global expansion

- BlockFi launches mobile app and hires former Credit Suisse and AmEx execs, targets crypto card and int’l expansion

- Dharma enables social payments via Twitter handles

- Bitfinex launches social trading platform

- FTX to launch US-based spot exchange in May; launches crude oil futures

- Bitnomial approved by CFTC to offer BTC futures and options contracts

- $166B asset manager Renaissance eyes participating in CME’s Bitcoin Futures markets

- Fidelity taps ErisX exchange for crypto trading liquidity

- Baakt CEO Mike Blandina steps down after 4 months

- NYDFS grants Bitlicense to ErisX

- Bittrex to launch Exchange Token in June

- BitMEX to restrict Japanese users amidst increasing regulation

- Greyscale inflows hit all-time-high, over $500M new capital in Q1

- Genesis doubles loan issuance to $2B in record Q1

News from emerging crypto businesses

- Clone of Compound suffers $25M hack, later returns all funds

- Libra hires former Bush and Obama Under Secretary as first CEO; and Checkout.com joins

- Visa teams up with Fold for their Bitcoin rewards card

- Synthetix launches Optimistic Rollup beta to test scalability

- Telegram asks US investors to leave their project and take 72% refund

- BitGO’s wBTC added as collateral type for MakerDAO

- Compound adds USDT for lending / borrowing

- A16z raises $515m for second crypto fund; later invests in NEAR’s $21m round

- Binance launches smart-contract blockchain similar to Ethereum

Tweets

- One of the smartest and most successful investors is now long bitcoin 📈

- Putin knows a thing or two about the blockchain

- Hegic makes a bold claim that bugs are really just “typos”

Something Fun

- Be sure to check out this incredible tale of a recent DeFi hack, investigation, and a remarkable return of all stolen funds!

The opinions expressed on this website are those of the authors who may be associated persons of Coinbase and who do not represent the views, opinions and positions of Coinbase. Information is provided for general educational purposes only and is not intended to constitute investment or other advice on financial products. Coinbase makes no representations as to the accuracy, completeness, timeliness, suitability, or validity of any information on this website and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. Unless otherwise noted, all images provided herein are the property of Coinbase, and all trademarks are the property of their respective owners.

This website contains links to third-party websites or other content for information purposes only (“Third-Party Sites”). The Third-Party Sites are not under the control of Coinbase, Inc., or its affiliates (“Coinbase”), and Coinbase is not responsible for the content of any Third-Party Site, including without limitation any link contained in a Third-Party Site, or any changes or updates to a Third-Party Site. Coinbase is not responsible for webcasting or any other form of transmission received from any Third-Party Site. Coinbase is providing these links to you only as a convenience, and the inclusion of any link does not imply endorsement, approval or recommendation by Coinbase of the site or any association with its operators.

Around the Block #6: Bitcoin’s dominance alongside Coinbase customer behavior, the coming DEX… was originally published in The Coinbase Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.