Around the Block #12: NFT mania

Coinbase Around the Block sheds light on key issues in the crypto space. In this edition, Justin Mart and Ryan Yi take a look at the mania around NFTs (non-fungible tokens).

At this point, NFTs have taken over public discourse of crypto in a way reminiscent of ICOs in 2017, including mainstream and pop-culture coverage. Global search interest for NFTs has now surpassed that of Ethereum’s ICO frenzy in 2017.

What is an NFT?

The term “NFT” can be quite generic, so let’s break down some of the confusion. A “fungible” asset is one that is mutually interchangeable. Think dollar bills, where each one is identical and interchangeable with another.

According to Coinbase Learn, “NFTs (or “non-fungible tokens”) are a special kind of crypto asset in which each token is unique. Because every NFT is unique, they can be used to authenticate ownership of digital assets like artworks, recordings, and virtual real estate or pets.” The distinction here is around the asset itself vs the authenticated ownership of the asset. As Nic Carter put it, “the NFT should be understood as the autograph, not the art.”

Take for example digital art. The art itself is a simple jpg or gif file that can be shared anywhere, and is entirely fungible with limited intrinsic value. However, the NFT of that same picture is unique, and serves as the socially-recognized record of ownership over that same picture. It lives on the blockchain as a unique token (dubbed an ERC-721), where anyone can see whose address it belongs to.

Viewed from this light, if you own an NFT, what do you actually own?

- It’s not a legal claim on the 0s and 1s that make up the digital art. There are no legal rights involved.

- It’s not physical ownership of the picture, NFTs are entirely digital

- It is a digital token that lives on a blockchain, which contains metadata that points to the art in question, and is freely transferable

- It is a socially-recognized record of ownership. The artist themselves (or whoever minted the NFT) bestows upon the owner special status as the owner of this artwork

That last part is the special sauce. NFTs are a social coordination game, where creators and communities can collectively assign and recognize ownership over digital goods. But it also belies an important point: the value of NFTs are directly tied to the issuer. For example, nobody would care if I minted an NFT of Jack Dorsey’s tweet — I am not Jack Dorsey. But it’s a different story if the NFT came directly from Jack.

In other words, NFTs are a sort of liability of the issuer, it is up to the issuer to honor the importance and provenance of the NFT, and whatever other special properties the NFT may bestow.

NFTs are a social concept of digital ownership. Why should we care? What makes NFTs interesting?

How many times have you bragged about discovering a band before they were cool? What if we could represent this dynamic economically, in a socially-provable way?

This is the magic of NFTs. They make this a possibility by tokenizing fan ownership and community involvement early on. Consider a band. For them, issuing NFTs of their albums and special events can be a way to reward their earliest adopters and biggest fans with special status and a unique connection. The fact that NFTs live on a blockchain also brings a more direct, economic relationship, where the band can provide discounts for concerts to NFT owners, or other special rights.

For creators, NFTs allow them to take control of the economics based on their brand power — they can go direct-to-consumer and smart contracts can guarantee that creators will capture a slice of all future sales.

In the end, owning an NFT plants a flag on your fandom, for all to see and recognize and for others to tap into. Additionally, NFTs enable novel new composable interactions — for example, the owners of a LeBron James Top Shot might also get reduced prices or exclusive access to other NBA merchandise, as they’ve proven to be high-value customers and deeply loyal fans. “Buying an NFT is angel investing into culture.”

What is the NFT lifecycle?

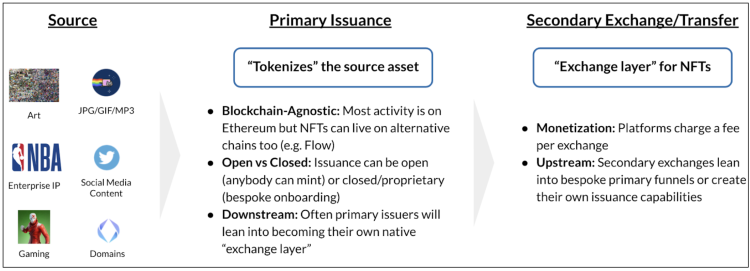

- Source: this can be any unique asset that exists. However, to drive value the source itself should come from the asset issuer (ie Jack’s tweet from Jack).

- Primary Issuance: these are platforms that “tokenize” the source into an NFT. Platforms can be closed (“invite-only”) or open (anybody can mint an asset).

- Secondary Exchange: these are platforms that facilitate the buy/sell of NFTs. Oftentimes, secondary exchanges have their own native primary issuance funnels.

The future of NFTs

Today, most cryptocurrency products live only in a digital format. But NFTs may begin to mark a transition where we may eventually be able to map real-world assets onto a blockchain in meaningful ways, perhaps including some sort of legal framework that secures actual ownership. In this future, imagine if a sports franchise like the LA Lakers tokenized their season tickets as NFTs? They could live in their fan’s wallets, secondary market price discovery could happen with P2P price discovery, and they would be immortalized as NFTs that live in this expansive, composable, digital metaverse.

News roundup

Retail

- BTC breaks $60K all-time high

- Etoro to go public via SPAC at $10B

- FTX wins naming rights to the NBA Miami Heat stadium

- Paypal acquires Curv

- Beeple sells $69M NFT via Christie’s

Institutional

- Blockchain.com raises $300M

- NYDIG raises $200M led by Morgan Stanley

- Fireblocks raises $133M led by Coatue (incl. BNY Mellon)

- Taxbit raises $100M led by Tiger Global

- Lukka raises $53M

- FalconX raises $50M led by Tiger Global

- Visa allows settlement of USDC on its network

- Avanti raises $37M

- Grayscale rolls out new trusts

- GBTC Trust falls discount to NAV

Ecosystem

- Uniswap v3 launches

- Dapper Labs (Flow) raises $305M

- Starkware raises $75M

- Opensea raises $23M

- Circle rolls out payments solution for NFT marketplaces

- Compound Grants program launches

- Livepeer launches Filecoin co-mining pilot

- Staked launches ETH 2.0 trust

The opinions expressed on this website are those of the authors who may be associated persons of Coinbase, Inc., or its affiliates (“Coinbase”) and who do not represent the views, opinions and positions of Coinbase. Information is provided for general educational purposes only and is not intended to constitute investment or other advice on financial products. Coinbase makes no representations as to the accuracy, completeness, timeliness, suitability, or validity of any information on this website and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. Unless otherwise noted, all images provided herein are the property of Coinbase.

This website contains links to third-party websites or other content for information purposes only (“Third-Party Sites”). The Third-Party Sites are not under the control of Coinbase, and Coinbase is not responsible for the content of any Third-Party Site, including without limitation any link contained in a Third-Party Site, or any changes or updates to a Third-Party Site. Coinbase is not responsible for webcasting or any other form of transmission received from any Third-Party Site. Coinbase is providing these links to you only as a convenience, and the inclusion of any link does not imply endorsement, approval or recommendation by Coinbase of the site or any association with its operators.

Around the Block #12: NFT mania was originally published in The Coinbase Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.