After the All Time High: Bitcoin’s record price brings renewed public attention, and public…

After the All Time High: Bitcoin’s record price brings renewed public attention, and public attention begets policymaker attention

December Market Outlook

Success attracts eyeballs. Sometimes that attention is desirable. Other times…well, it’s complicated.

As bitcoin and the cryptoasset space enjoyed arguably its best month ever in November, with media and Wall Street investors trumpeting bitcoin climbing to another new all-time price high, regulatory storm clouds began forming.

From rumors of new regulations in the final days of the Trump administration aimed at non-custodial wallets to Congressional legislation clamping down on stablecoins, there has been a slew of new regulatory developments.

Notable regulation has been with the cryptoasset space since spring 2013 when the US Financial Crimes Enforcement Network (FinCEN) issued its first guidance around cryptocurrency. In our view, FinCEN set a good regulatory example, striking a reasonable balance between upholding public safety interests and creating space for innovation. Bitcoin’s price even rallied around the FinCEN announcement.

But in the still relatively short history of cryptocurrencies we have also seen the opposite occur. In certain cases, overly heavy-handed and uninformed regulation has threatened to drive innovation and jobs offshore, and ultimately proven counterproductive.

In short, regulation can cut both ways.

As we can expect the coming months to feature renewed regulatory focus we were thrilled to have Peter Van Valkenburgh, director of research at Coin Center, on this month’s webinar and podcast.

Now, we’re pleased to offer you our latest thoughts on what’s driving crypto markets and analysis of bitcoin on-chain activity this month.

Summary

- November Markets: Bitcoin sets a new all time high while gold plunged

- For the month Bitcoin (BTC) and Ethereum (ETH) were up 43% and 57%, respectively, with Ethereum bouncing back from underperforming relative to bitcoin in October

- On November 30th bitcoin set a new all-time high of ~$19,783 and is up 173% YTD; Ethereum is up 373% YTD but still more than 50% below its all-time high

- Gold was down for a third consecutive month, plunging -5% even though the US dollar resumed its 2020 slide -2% for the month, hitting its lowest level in two and a half years

- Equities reversed October’s losses to gain 11% for the month and are up 12% YTD, while long-dated US Treasuries gained +2% and are now outperforming gold for 2020 (+18% vs +17%, respectively)

2. On-chain insights: Highlights from the Blockchain.com data science team

- Record setting November bitcoin price action occurred alongside a strong increase in bitcoin on-chain activity.

- Bitcoin mempool size showed lower activity in November 2020 than during the December 2017 bull run, bolstering evidence that the recent bull run is institutionally and not retail driven

- How on-chain measurements of bitcoin ownership concentration can be misleading, particularly during periods of significant price spikes

3. How I Learned to Stop Worrying and Love Unhosted Wallets

- Over the past year, governments around the world have expressed concern about the risks associated with the use of “unhosted” wallets

- Prohibitions against personal cryptocurrency transactions are not only impractical and ineffective at deterring illicit activity, they actively undermine efforts to combat it

- Overall, policymakers would be wise to heed King Canute’s warning about the futility of stopping the ocean’s tides from rising

4. What we’re reading, hearing, watching

1. November Markets: bitcoin sets a new all time high while gold plunged

In November crypto continued its strong Q4 with bitcoin setting a new all-time high of ~$19,783 on November 30th (Table 1). For the year bitcoin is now up 173%.

For the third time this year Ethereum (ETH) showed a monthly gain of 57%. The other months when this happened were April and July, with June the best month this year for $ETH at +70%.

Table 1: Price Comparison: Bitcoin, Ethereum, Gold, US Equities, Long-dated US Treasuries, US Dollar (% Change)

November was an extraordinary month for bitcoin and crypto as a whole, with positive developments in particular coming from Wall Street and institutional investor adoption. Fabled hedge fund manager Stan Druckenmiller publicly disclosed for the first time that he now owned bitcoin, while longtime bitcoin skeptic Ray Dalio, founder of the world’s largest hedge fund, acknowledged that he “might be missing something” with his traditionally bearish bitcoin stance.

What’s going on with gold?

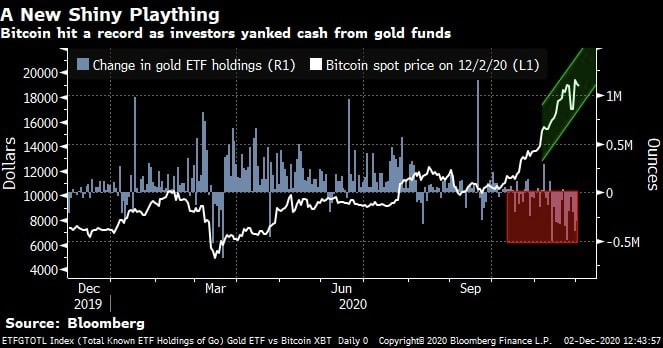

One potentially significant longer-term development we will be watching was the divergence in November between the price of bitcoin and gold, which dropped -5% for the month. There is some discussion that gold investors may be rotating into bitcoin, and outflows in November from Gold ETFs offer potential evidence of this. BlackRock Chief Investment Officer Rick Rieder gave an interview on CNBC on the 20th November where he suggested bitcoin could replace gold.

The downward move in gold in November was particularly striking given that the US dollar resumed its 2020 slide to hit a two and a half year low and inflation concerns continue, fueled by growing calls for more extraordinary fiscal stimulus.

We have argued that gold and bitcoin can be viewed as complementary, and Blockchain.com recently launched wrapped Gold (wDGLD). The total market value of all gold is approximately $10 trillion, or over 20x the size of the market value of bitcoin (~$350 billion). Any sustained move by gold investors to diversify their hard asset portfolio into bitcoin should provide strong support for further bitcoin price appreciation.

Long-dated US Treasuries gained +2% and are now outperforming gold for 2020 (+18% vs +17%, respectively), while equities reversed October’s losses to gain 11% for the month and are up 12% YTD.

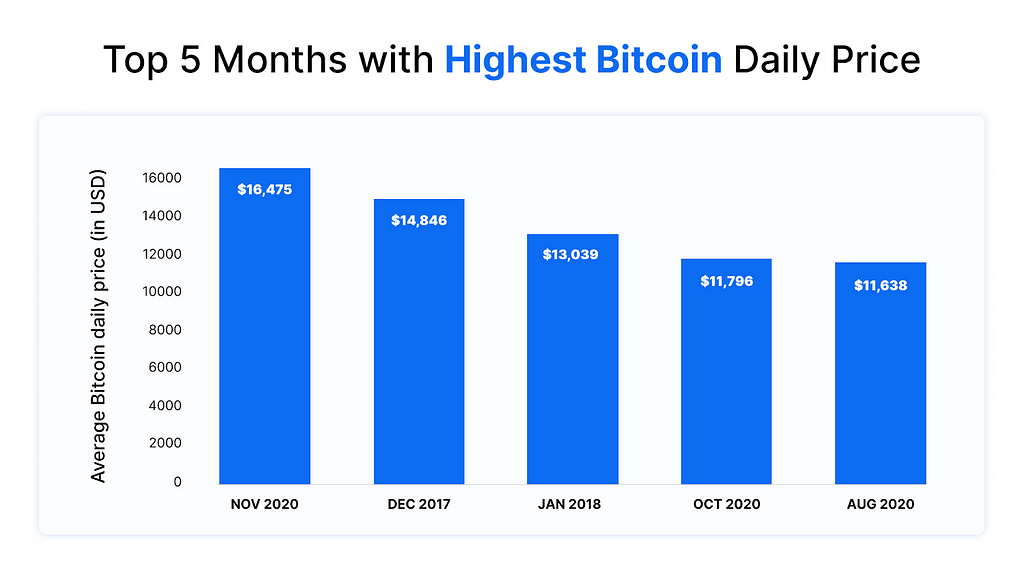

Overall, 2020 is shaping up to be arguably crypto’s best year yet on a number of levels. It is not surprising to see that three of the top-5 best months in history for average crypto prices are now from 2020 (Figure 1).

Figure 1: Top-5 Months by Average Daily Bitcoin Price

2. On-Chain Analysis

Each month we dive into on-chain data to explore interesting trends or movements on the Bitcoin network. (Table 2)

Table 2: Bitcoin network activity — November vs October

The record setting November bitcoin price action occurred alongside a strong increase in bitcoin on-chain activity. There was an increase of 1.8% in the number of daily transactions and 3.4% increase in the number of daily payments; daily number of active addresses were also up 8.9%.

This increased activity resulted in the average fees per transaction being higher in November with an average of $6 per transaction, which is still much lower than what was observed during the 2017 bull run where the daily average fee per transaction remained above $20 during more than 30 days.

Last month we were talking about the sudden 25% drop in estimated hash rate towards the end of October. It has now bounced back from 108 EH/s to a solid 129 EH/s on average, thanks to the difficulty adjustment and an increasing bitcoin price attracting additional mining hashing power. (Less efficient mining hardware can again become profitable to operate as the bitcoin price rises.)

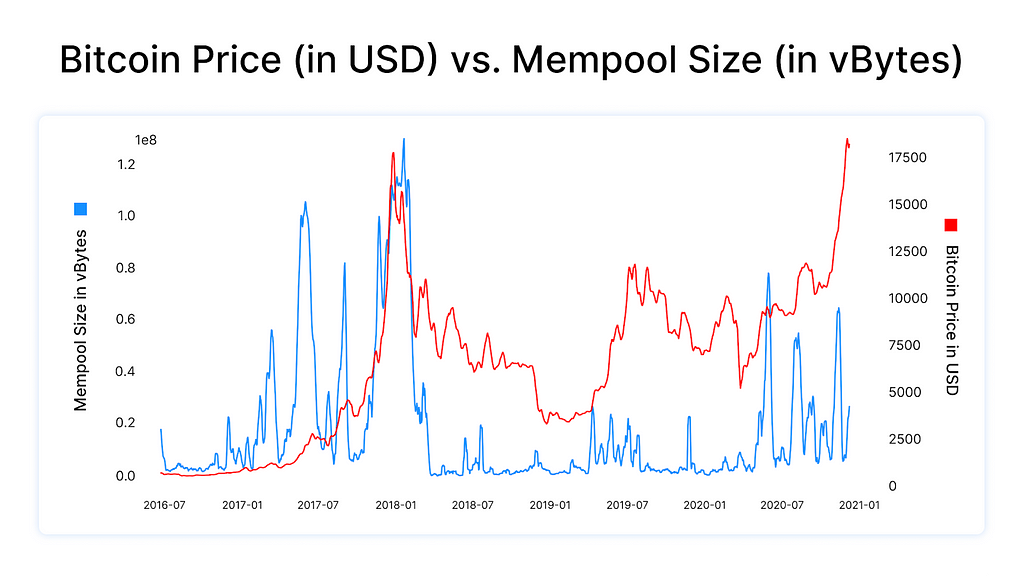

Bull run comparison: December 2017 vs November 2020

The mempool is where all the valid transactions wait to be confirmed by the Bitcoin network before being added to the blockchain. A high mempool size indicates more network traffic.

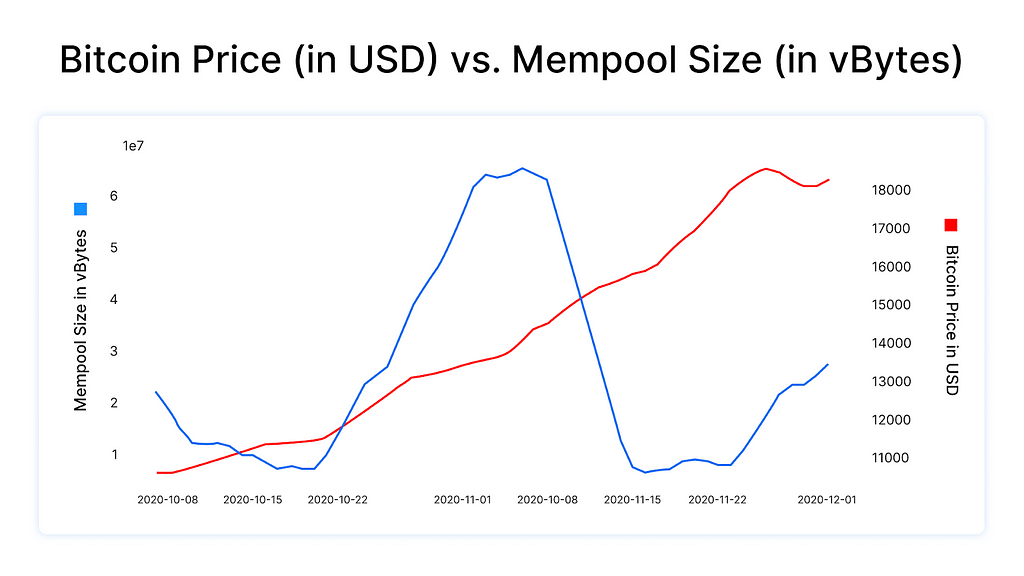

Interestingly, the recent price action saw relatively low levels of mempool activity in comparison to the previous bull run in December 2017 (Figure 2a).

Figure 2a: Mempool size showing lower activity in November 2020 than during the December 2017 bull run

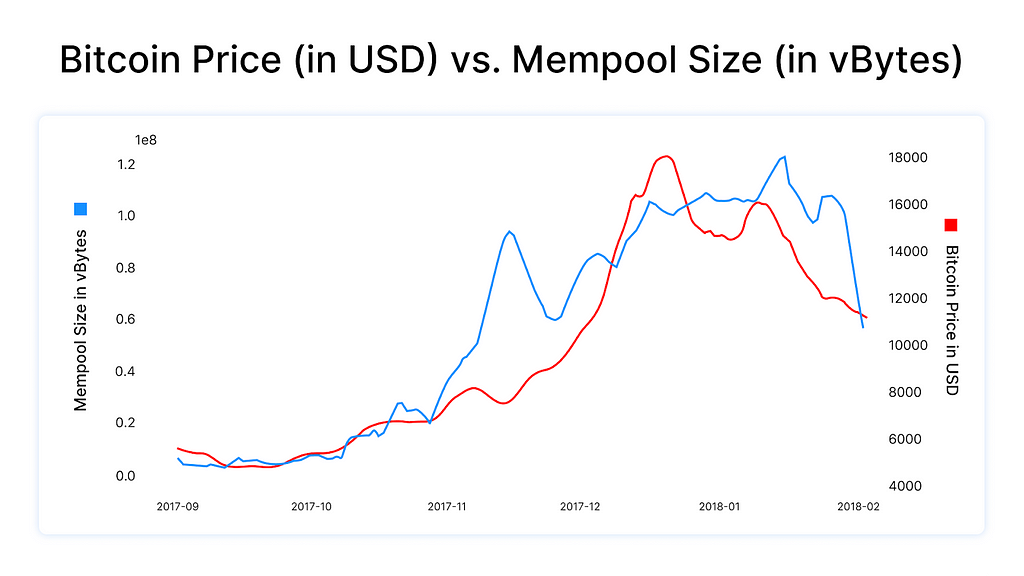

Looking more closely, Figure 2b shows that the mempool size remained high during the 2017 bull run, with a tight correlation between mempool size and price.

Figure 2b: December 2017 bull run saw an uptick in mempool size as the price increase

Activity in November 2020 initially shows a similar pattern as 2017, with the mempool size going back to usual levels in the middle of the bull run (Figure 2c). Part of the recent transaction backlog was caused by a decrease in hash rate just before the difficulty adjustment on the 3rd of November, as opposed to an abnormal increase in on-chain transactions.

Figure 2c: Mempool size remained low in November 2020 apart from a short spike mainly due to the decrease in hashrate — not the price

This suggests two possibilities:

- On-chain transactions are more efficiently conducted nowadays with batched transactions and segwit transactions being more widely used (ie withdrawals from exchanges that batch transactions occupy less block space)

- Price action is driven more by off-chain exchange and big institutions rather than retail transactions, which perhaps would have a bigger share of transactions settled on-chain

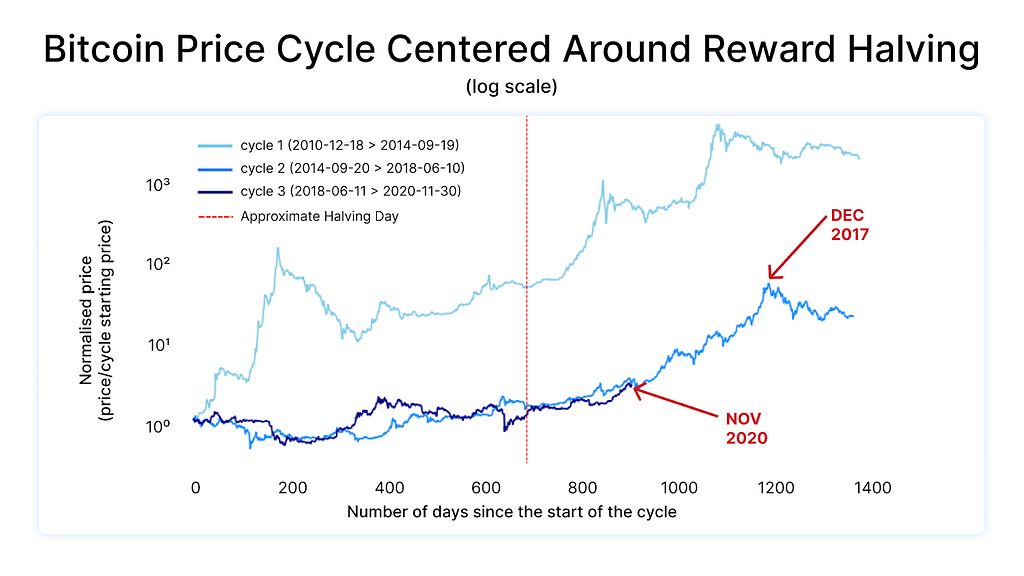

On another note, while the December 2017 rally around the $19k price mark occurred towards the end of the halving cycle, we are currently still relatively early in the cycle (Figure 3).

Figure 3: November 2020 bull run is earlier in the halving cycle than December 2017

On-chain bitcoin ownership concentration measures can be challenging to interpret during significant price swings

One concern that has arisen about bitcoin is ownership concentration. More specifically, the concern is that a relatively small number of people control an outsized share of bitcoin relative to ownership concentrations of other assets. This concern has been cited by the US Securities and Exchange Commission as one of the reasons for their reluctance to approve a bitcoin ETF.

We continue to monitor on-chain metrics to try to gain a sense of how bitcoin ownership concentration is evolving. While on-chain metrics would appear to suggest a slight decrease in the number of individual owners of bitcoin in November, these data can be misleading, particularly during big price swings like we’ve seen recently.

In November we saw a slight decrease from October in the number of individual bitcoin addresses holding both 0.1 and 1 bitcoin:

October 2020

- 3,178,169 addresses (9.59% of total addresses) have more than 0.1 BTC, and represent 98.82 % of total bitcoins

- 822,971 addresses (2.48% of total addresses) have more than 1 BTC, and represent 94.82 % of total bitcoins

November 2020

- 3,115,354 addresses (9.38% of total addresses) have more than 0.1 BTC, and represent 98.85 % of total bitcoins

- 821,358 addresses (2.47% of total addresses) have more than 1 BTC, and represent 94.95 % of total bitcoins

How do these decreases align with reports of significant increases in the number of new owners of cryptoassets during the month of November? Several possibilities exist.

First, it is likely that many new cryptoasset owners are primarily utilizing third-party intermediary exchanges that hold cryptoassets on behalf of individuals, such as PayPal, Square, and the Blockchain.com Exchange. A growth in new users of custodial exchanges would not necessarily show up in on-chain ownership dispersion statistics.

Further, during periods of big price swings coins tend to move more frequently than during “crypto winter” periods. The address count decline could reflect individual owners moving coins to exchanges or consolidating balances.

One thing we can say for certain: recent price gains have made all bitcoin holders, regardless of their levels of ownership, better-off financially (Table 3).

Table 3: Bitcoin owner wealth increasing

3. How I Learned to Stop Worrying and Love Unhosted Wallets — Guest Post by Coin Center

Self hosted (or “unhosted”) wallets have become a bigger part of the regulatory conversation around cryptocurrencies in 2020. This month, rather than publish a guest post, we want to highlight a piece from our friends at Coin Center.

Jai Ramaswamy, a former US Department of Justice Anti-Money Laundering (AML) Chief who is now at cLabs, writes about the possibility of new regulations targeting self hosted wallets, and why this would be bad policy for all interested parties.

Over the past year, governments around the world have expressed concern about the risks of illicit financial activities such as money laundering, terrorist financing, and the evasion of international sanctions arising from the use of “unhosted” wallets — software applications that allow users to conduct pseudonymous, personal transactions in crypto assets over the internet without the use of a financial intermediary.

After covering some history of the issue, he offers an undeniable explanation for why this would be misguided:

Perhaps most importantly, policymakers must come to terms with a technological shift that is driving the rise of decentralized blockchain protocols. Those changes have the potential to transform the architecture of the internet, collapse the distinction between communication and settlement of value on networks, and rewire some of the ways we think about financial services, particular in driving financial inclusion.

Critically, these are primarily technological advances that give rise to financial innovations, and thus policymakers seeking to prohibit or restrict their development and use would be wise to heed King Canute’s warning about the futility of stopping the ocean’s tides from rising. A sober review of the technology explains why such efforts are bound to fail and will only serve to undermine rather than enhance efforts to detect and disrupt illicit financial activity.

And why it might make law enforcement’s job harder:

Prohibitions or restrictions against personal cryptocurrency transactions are not only impractical and ineffective at deterring illicit financial activity, they can also actively undermine efforts to combat it. This should come as no surprise since restrictions on blockchain technology and personal cryptocurrency transactions are analogous to capital controls, which tend to drive financial activity into underground black markets where they have been adopted. Black-market peso exchanges, hawalas, and other informal channels that support illicit financial activity were born in part because of capital controls that deprive businesses and individuals — including many on the margins of the financial systems — of legitimate and safer institutional channels to meet their daily economic needs.

The full article is a lengthy read, but it is an important policy argument for anyone watching the cryptocurrency space to understand.

4. What we’re reading, hearing and watching.

Crypto

- Adventures In Capitalism: Why This Reflexive Ponzi Scheme Will Continue…

- Barron’s: Bitcoin Could Hit $500,000, the Founder and CEO of Ark Invest Says

- Blockchain Capital Blog: Bitcoin is (Still) a Demographic Mega-trend: Data Update

- Bloomberg Opinion: Bitcoin Is Winning the Covid-19 Monetary Revolution

- Coindesk: Digital Voting Is Coming. Let’s Do It Right.

- Coindesk: US Intelligence Chief Raises Concerns With SEC Over China’s Crypto Dominance: Report

- Coin Metrics: Coin Metrics’ State of the Network: Issue 78

- Lyn Alden: 7 Misconceptions About Bitcoin

- The Block: JPMorgan reports ‘modest outflows’ for gold funds as more than $1 billion poured into Grayscale in Q3

- The Block: Ripple buys back XRP for the first time to support ‘healthy markets’

- The Block: Top Japanese banks, companies to test private digital currency next year

- The Reformed Broker: Five Reasons Why Bitcoin is Going Up

Beyond Crypto

- Economic Principals: At the End of “Morning in America”

- Lux Capital: The once obscure, derided financial product that just might transform deep tech venture capital

- Money and Banking: The Case of the Treasury Account at the Federal Reserve

- Noahpinion: I will never get to go to Hong Kong

- Project Syndicate: How Much Debt Is Too Much?

- Project Syndicate: The Siren Song of Austerity

- The Atlantic: The Next Decade Could Be Even Worse

- The Economist: China’s bond market is jolted by some surprising defaults

- The New York Times: Economic Policy Has Become a Partisan Game. That Could Do Long-Term Harm.

- The Political Informer: The Rogers Adoption Curve & How You Spread New Ideas Throughout Culture

- Yahoo Finance: Janet Yellen at Treasury Points to Era of Fed Control

After the All Time High: Bitcoin’s record price brings renewed public attention, and public… was originally published in @blockchain on Medium, where people are continuing the conversation by highlighting and responding to this story.